I really wish I was not right here, right now, writing this blog post. I will be upfront with you, it is very embarrassing to put this out here publicly, but that’s why I want to do it. No one likes to make mistakes, admit mistakes and worse yet, publicly talk about them like I am about to do. In other words, my main motivation for writing this is to shame myself into not repeating the inexcusable mistake I have made. On top of this, if people can learn from what I allowed to happen, then that is a great thing!

The Context of My Trading Mistake

First off, I want to say that none of this is an excuse. This mistake was solely my fault and the only person to blame is who I see in the mirror every day. The point of setting up this context so people can hopefully be able to relate to me and therefore learn how to avoid what I allowed to happen.

I am a very competitive person by nature. Whether it be in sports, business, or board games… I am very competitive. I would argue this personality trait is needed to have any chance at success within trading; however, as a basic economic principle states: there are always trade-offs.

In this case, I fell into the trap created by winning streaks. Because I am so competitive by nature, I found myself in a situation where I had a chance to break a new personal record. What was this record I apparently cared so much about? As trivial as it may seem, this record had to do with the number of consecutive winning days I’ve had in my trading career.

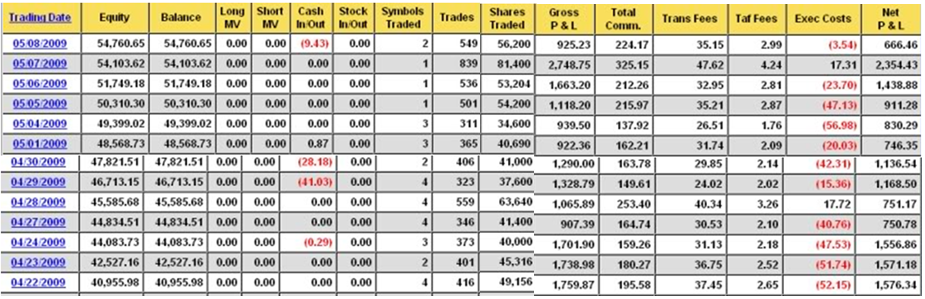

Below you can see a screen shot (click image to enlarge) showing this record of 13 winning days in a row. While hard to read, looking at the dates to the far left, you can see this is from 2009, so yes, this record has been around for quite a while within my trading career.

On a side note, this is why I always laugh when people say charts are random, a “flip of the coin”, don’t work, etc. I mean sure, a few winning days in a row could be produced by something that is random, but 13 winning days in a row? For something that is supposedly a “flip of the coin”, 13 green days in a row seems sort of unrealistic (I’d love to see someone flip “heads” or “tails” 13 times in a row). Anyways… I’m getting off topic.

For me, having seven to nine green days in a row is pretty common. I don’t say this to brag, I say this to provide context to the psychological state I was in before I made my mistake.

The Mistake I Need to Learn to Avoid

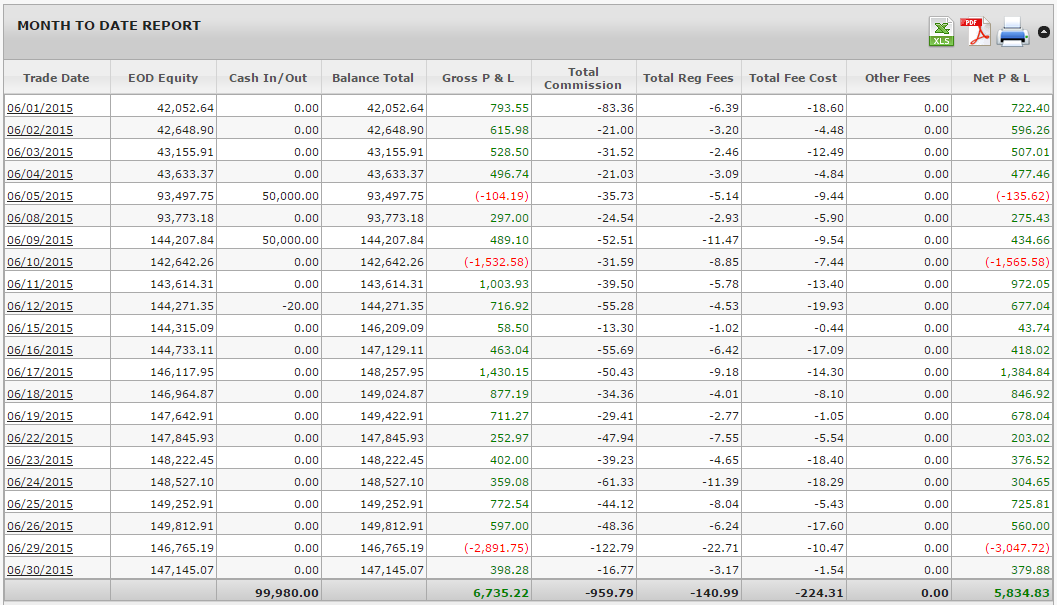

Now that the context has been set up, take a look at the image below (click image to enlarge) – particularly at the dates of 6/11/15 and 6/26/15. Why are these dates important? When you count up the days between them, you will notice it adds up to 12 days. You’ll also see that all 12 of those days were green. Uh oh…

(I know people will ask, so I’m going to answer it right now. Why was I moving those amounts of money into my account? I am transitioning more into advanced option trading such as naked calls/puts, and my trading brokerage requires larger amounts of capital in order to do these types of strategies. Along with this, I also sold a piece of real estate from my portfolio and will be using those funds for these advanced options)

So the little voices in my head went something like this…

“Clay! Look! You are one day away from tying your all time record from 2009! You are only two days away from setting a new personal best! Let’s do it buddy! You can do it!”

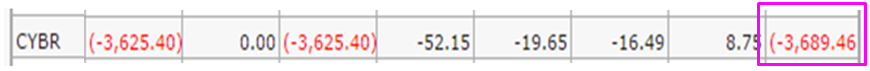

So then June 29th rolls around… a Monday… a brand new week. I see CyberArk Software, Ltd. (CYBR) trading in a pattern that I like, so I put together a trade plan, and hop in.

I specifically remember the number on my screen when my disciplined voice said, “time to get out” and it was slightly below $500, but to keep the math simple, let’s just call it $500. But then those other voices popped back up saying…

“Clay! Don’t be foolish! You can trade your way out of this. The streak is on the line. You are so close! Don’t let it go down the toilet now! Get focused and trade your way out of this mess!”

And you know what? I listened to these voices, I let pride get in the way, and below you can see what a $500 loss turned into…

Wow… that trade is embarrassing to admit. Ugh… please don’t think I’m a terrible human being! Haha (this is the “I am so embarrassed” type laughter).

What is the moral of the story here? We all have voices in our heads. If you haven’t traded yet, don’t you worry, once you get real money on the line, they’ll come talk to you. When you listen to the voices that are telling you to break the rules of your plan… the above is what can happen. I assure you, it is not a pleasant experience… at all… not even a little bit.

The One Trading Rule I Did Right

Believe it or not, I did actually do a couple things right during the final two days of June. The first thing I did right was to tell the moron voices to SHUT UP! Even after the disastrous trade, they returned again saying (ever notice how the voices try to comfort and motivate you into doing dumb things?)…

“Clay! Keep your head up! You are a good trader. You have a good strategy. Don’t be discouraged It’s time to get revenge on the market. Increase your share size and you can dig out of this hole and make it green again so you can get back on track to breaking a new record!”

I may have been very stupid on this trade, but the one thing I’ve learned is when you do something stupid, admit it and then implement the damage control rules. I have tried revenge trading many times, and many times the results of revenge trading are not favorable. After telling my moron voices to SHUT UP, I put into place this very basic, yet highly effective trick of reducing position size which kept my risk under control the remainder of the day.

Looking back up at the monthly statement, you will notice I actually closed the day down “only” $3,047.72, so I was able to salvage $640 the remainder of the day. Did I make back my losses? Nope. Did I come even close? Nope. Did I ensure that the hole did not get any deeper? Yes. And THAT is the important part. Don’t let one bad trade spin out of control and affect the remainder of your day!

I did the second thing right by, once again, implementing the position sizing trick the next day to ensure I didn’t put a dent into my month any further. Like I stated with the logic above, did making $379 even come close to digging me out of that hole? No, it did not, but it ensured I would still have a green overall month.

Now I don’t want to come across like a greedy pig or ungrateful. For a Summer month (and for sitting around in my underwear all day and being able to work from home), $5,800 is still a good paycheck…BUT, just to shame myself some more and hopefully drive the point home for you to NOT listen to the voices, consider this (I realize I’m talking a bit in hindsight’s and assumptions, but humor me will ya?…

- If I listened to my disciplined voices, I would have lost $500 on CYBR.

- I then made $640 the remainder of the day.

- This puts me at a green day of $140. ($640 wins – $500 loss)

- I then closed the final day of June green in the amount of $379.

- That would have put me at 14 days green… a NEW RECORD…

More importantly, that would have put me at just around $9,000 on the month… INSTEAD of where I closed at $5,800, to me, that’s a pretty big difference. And to think, I could have had a solid summer month, a new winning streak, but because of one single trade where I listened to the dumb voices, it turned me into a dumb trader and the final picture is much different.

Please Learn from My Public Shame

I plan to personally refer back to this blog post whenever those “winning streak voices” pop back into my head, so I plan on learning from this experience. I hope you do too!

Trust me, it’s much better to learn from SOMEONE ELSE losing money than you losing your own money and having to learn. When you set up a plan, follow it. Don’t focus on things that don’t matter such as winning streaks, because as you’ve seen, when you focus on the wrong things, all it takes is a single trade to really put a damper on the party.

Have you ever been here before in terms of doing something really dumb? Please take the time to share below in the comments section. I think it could be really cool and helpful to collect a group of “dumb things” people have done so that future traders are hopefully motivated on what NOT to do.