The number one question I receive on a constant basis from stock traders is “How do I become successful trading stocks?” This is a great question since I believe it shows the person is willing and ready to better themselves as a stock trader.

Trading stocks for a living is one of the most enjoyable jobs a person can have. Heck, you don’t even need clothes. You can be like me and roll out of bed and head down to the computer in your underwear (sorry, was that a bit too much detail?).

I have some good news and bad news for you.

I will start with the bad. The reality of the situation is, quite frankly, the majority of stock traders fail. Sure everyone scores a winning trade now and then, but over the long haul, their portfolios remain the same, or worse yet, dwindle down to nothing.

The good news however is that the reason most traders fail can be avoided. The question really boils down to are you willing to do what needs to be done in order to separate yourself from the rest and succeed?

I believe it is a safe assumption to make that 99 out of 100 traders would answer that question with, Yes! I am willing to do whatever needs to be done to succeed! The problem is, due to human psychology, it is not as easy to do as it may seem.

The Thought Process of a Beginning Stock Trader

I am sure we have all been here before. You make a trade and score a big winner. At this point, you feel on top of the world and like you have this trading thing all figured out. This is totally understandable given that is a natural human emotion. Your thought process is going to follow along these lines:

I am sure we have all been here before. You make a trade and score a big winner. At this point, you feel on top of the world and like you have this trading thing all figured out. This is totally understandable given that is a natural human emotion. Your thought process is going to follow along these lines:

Made Money >>> I Know What I Am Doing >>> In Order to Make More Money, Must Spend Money >>> Enter Into New Trade

I am also very confident we have all been here before. You enter into a trade that does not work out the way you wanted it to and eventually you sell for a loss. At this point, you are mad, frustrated, angry and bottom line, want your money back! Your thought process goes something like this:

Lost Money >>> Need to Get Money Back >>> In Order to Get Money Back, Must Spend More Money >>> Enter Into New Trade

While you may think the first thought process is correct, I’m here to tell you that neither of them are correct. These two thought processes are what I like to refer to as the Viscous Cycle of Failure.

The Viscous Cycle of Failure

Let me ask you a question. What do you think a plumber, lawyer, doctor and school teacher all have in common?

If you responded with an answer close to this, then well done:

they all received some sort of education and/or training before starting their careers.

Let me ask you another question. What do you think the difference between the above mentioned careers and stock trading are?

If you responded with something similar to this, then again, well done:

there is no barrier to entry to become a stock trader besides having money to trade.

To put this bluntly, anyone with a few dollars to spare can sign up for an online brokerage account, and all of a sudden, *wave magical wand*, they are a “stock trader” (wow – that was easy!).

To put this bluntly, anyone with a few dollars to spare can sign up for an online brokerage account, and all of a sudden, *wave magical wand*, they are a “stock trader” (wow – that was easy!).

Do you think it would be wise to allow a plumber, lawyer, doctor or school teacher to start a career in one of those fields without any kind of education or training?

So then… why in the world do people think they can just open an online trading account and have consistent success with no training or education!?!?!? (Keyword: consistent)

Do people actually believe this? They certainly do! What is my proof? Easy… ME!!!

My Personal Experience & Journey with the Cycle

My story begins when I was in college. I discovered the stock market and was fascinated with the fact that you could make money by pressing buttons at your computer screen without ever leaving your room.

After doing a bit more research and confirming that this indeed “is” how the stock market worked, I decided that I wanted to become a “trader” (and I am using that word very loosely).

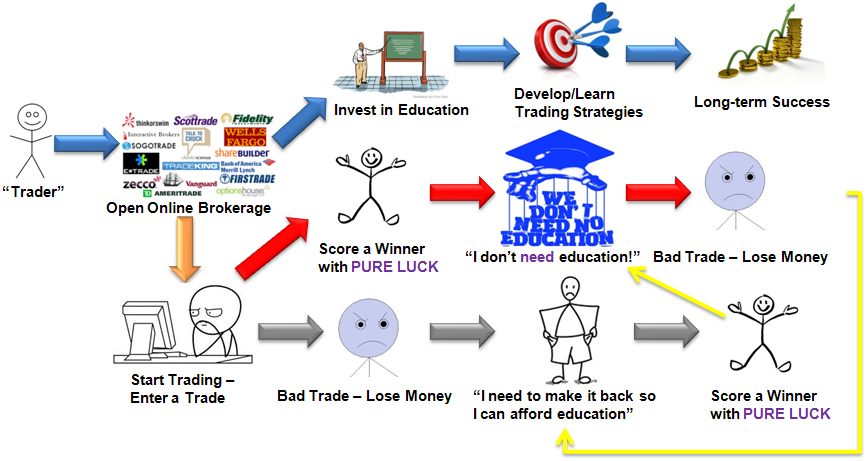

I decided I would try and illustrate my journey below.

Because I had all of a sudden proclaimed myself a trader, the next logical step was to sign up for an online brokerage account. I wired in some cash from a college job I had, and with basically a snap of my finger, I was ready to get started.

Because I had all of a sudden proclaimed myself a trader, the next logical step was to sign up for an online brokerage account. I wired in some cash from a college job I had, and with basically a snap of my finger, I was ready to get started.

Perhaps this sounds over-dramatic (it is the truth however), but this point in the process is going to determine your success or failure as a trader.

For me, the pure excitement and adrenaline that was surging through my body made this choice easy (not to mention the limited funds I had – why would I even think of spending that on training/education?!?!), I chose to Start Trading so I entered into a trade.

For me, the pure excitement and adrenaline that was surging through my body made this choice easy (not to mention the limited funds I had – why would I even think of spending that on training/education?!?!), I chose to Start Trading so I entered into a trade.

My first ever stock trade was Level 3 Communications, Inc. (LVLT) and it turned out to be a success. I had Scored a Winner, my strategy = PURE LUCK, but at the time I just tricked myself into believing that I actually knew what I was doing.

With my new found confidence, my thoughts towards needing education and training widened that much more. I just Scored a Winner, why would I need to spend any of my profits on education? The better choice would be to spend the profits on more trades so that I could make more profits! This seemed like an extremely easy decision to me.

With my new found confidence, my thoughts towards needing education and training widened that much more. I just Scored a Winner, why would I need to spend any of my profits on education? The better choice would be to spend the profits on more trades so that I could make more profits! This seemed like an extremely easy decision to me.

I then entered into three separate stocks at once. To make a long story short, two of the trades were losers (and it wasn’t even close), and the other trade was a winner (but it was very close to being a loser). These Bad Trades that caused me to Lose Money brought me back to reality quicker than I could blink.

After I finished eating my humble pie, I accepted the fact that this stock trading thing was a bit tougher than I had estimated. I certainly did not enjoy losing my hard earned money (especially as a college student), so I concluded that some education would be worthwhile. I had a problem though…

After I finished eating my humble pie, I accepted the fact that this stock trading thing was a bit tougher than I had estimated. I certainly did not enjoy losing my hard earned money (especially as a college student), so I concluded that some education would be worthwhile. I had a problem though…

Although I “did” have enough money to spend on training, my psychological mindset was that I did not have enough money since I had just lost some. This  trick that my mind played on me lead me to the thought of “I need to make it back so I can afford an education”.

trick that my mind played on me lead me to the thought of “I need to make it back so I can afford an education”.

“I need to make it back” -ugh! That is a cruel cruel cruel mind trick as more often times than not, it causes us to make even more bad decisions with our money. And that’s exactly what I did…

My very next trade was a good size winner. The mind is a very weird place. In the span of a week I had gone from “Ugh… I need education” to “Education? I don’t need no education!“

I can’t remember exactly how I rationalized things, but it probably went something like this: “Those losing traders were just bad luck. It was a perfect storm of “badness” that aligned against me. I know what I’m doing now!”

I can’t remember exactly how I rationalized things, but it probably went something like this: “Those losing traders were just bad luck. It was a perfect storm of “badness” that aligned against me. I know what I’m doing now!”

Here I was… trapped in a cycle that I didn’t even know I had entered into. Now that I had my confidence back, I prepared to spend those “profits” (they weren’t profits, the trade had just brought my portfolio back to even) so I could make more money!

I then found a message board that lead me to the stock that would eventually break my heart. I still had no strategy or foundation to build from, so I just read message board posts and blogs about how great this company  was (they made high quality mufflers – haha). It was a penny stock and I truly thought it was going to at least a dollar (when at the time its price per share was only a few pennies). I genuinely thought I had figured it all out and that I was going to be a millionaire.

was (they made high quality mufflers – haha). It was a penny stock and I truly thought it was going to at least a dollar (when at the time its price per share was only a few pennies). I genuinely thought I had figured it all out and that I was going to be a millionaire.

This stock, $FCCN, in the end cost me about $1,500 of my portfolio. While that may seem like an earth shattering number, to me (a college kid), it might have well as been a million dollars. Hitting the sell button was the low point in my trading experience. Here I had thought I was going to be rich, and in a click of a button I was now poorer. If that isn’t irony, I don’t know what is.

A s painful as the whole experience was, it was also the best thing that could have happened to me. I mentioned “low point” above on purpose, because that’s exactly what it was. This is the event in my trading story that allowed me to escape the cycle. It was a good ole fashioned slap across my face that made me realize I had no idea what I was doing. No foundation. No strategy. I might as well have been playing a game of darts.

s painful as the whole experience was, it was also the best thing that could have happened to me. I mentioned “low point” above on purpose, because that’s exactly what it was. This is the event in my trading story that allowed me to escape the cycle. It was a good ole fashioned slap across my face that made me realize I had no idea what I was doing. No foundation. No strategy. I might as well have been playing a game of darts.

Although my mind was yelling at me, “We need to make all that money back! Get into a new trade and then we can spend money on training!”, I ignored… ignored… ignored… and chose to Invest in Education. The first step, what kind of analysis strategy do I want to use? For me, I knew I had to get emotions out of the process (remember, I just had my heart broken), so technical analysis seemed like the best fit for me, so the education investing began. I Developed and Learned Trading Strategies and the rest is history…

Although my mind was yelling at me, “We need to make all that money back! Get into a new trade and then we can spend money on training!”, I ignored… ignored… ignored… and chose to Invest in Education. The first step, what kind of analysis strategy do I want to use? For me, I knew I had to get emotions out of the process (remember, I just had my heart broken), so technical analysis seemed like the best fit for me, so the education investing began. I Developed and Learned Trading Strategies and the rest is history…

I am now the most followed trader on the very same message board that led me to the stock which broke my heart, but more importantly, pulled me out of the vicious cycle.

I am now the most followed trader on the very same message board that led me to the stock which broke my heart, but more importantly, pulled me out of the vicious cycle.

Can You Relate to My Experience at All? Here is the Solution

I know my experience is not unique. I’m sure there are plenty of things that may differ with your story, but I’m also sure those “things” are minor details. The core is still the same: stuck in the cycle.

Maybe you’ve already hit your low point. Maybe you’re at one of the other stages of the cycle (feeling confident? feeling like education is a waste? “want” education, but “think” you can’t afford it?). Maybe your in the great spot of just having decided you want to trade.

Here is the beauty of things. It is very easy to figure out if you are stuck in the cycle. All you have to do is ask yourself…

Is my trading portfolio increasing, decreasing, or remaining the same?

Is my trading portfolio increasing, decreasing, or remaining the same?

If your answer is either “decreasing” or “remaining the same”, then you are stuck in the cycle (whether or not you want to accept that fact is a whole other discussion).

If you are still reading this, you know what step in the cycle you must get to. It is time to Invest in Education. I know this is easier said than done. There is no stage that makes it easy. You are either…

- Just signing up for an online broker = super excited I want to get started… NOW!

- Just Scored a Winner = “I don’t need no stinkin’ education. I have it all figured out!”

- Just made a Bad Trade = “I don’t have enough for education. I need to make that money back.”

Going full circle, this is the opportunity to separate you from the majority. Luckily, for me, that heart break was enough to jolt me out of the cycle, but it still wasn’t easy. The question is, are you willing to do what needs to be done in order to separate yourself from the rest and succeed?

Going full circle, this is the opportunity to separate you from the majority. Luckily, for me, that heart break was enough to jolt me out of the cycle, but it still wasn’t easy. The question is, are you willing to do what needs to be done in order to separate yourself from the rest and succeed?

You know what you have to do. Just do it…

Stock Trading Education Choices

I’m biased (and I have no problem admitting that), so my first recommendation would be to check out my educational/training store of instant download course.

I am all about technical analysis and the use of charts (I love how they eliminate the emotions… I do NOT need my heart broken again! Ugh!), so if you are new to this analysis process, or don’t have much confidence with it, then you need to check out my Robotic Trading course as part of the Trading Freedom Pathway. I will not ask you to take my word for it though. What I will ask is that you read the testimonials from the many other traders who have already purchased the course.

While I certainly hope you choose to learn from one of my course, at the end of the day, if you want to get out of the cycle, you need to Invest in Education. Whether that is through my help or by some other means, the pathway to success is paved with having a foundation to build strategies from.

So what are you waiting for? Get on it. Today you break out of the cycle!

Is my trading portfolio increasing, decreasing, or remaining the same?

Is my trading portfolio increasing, decreasing, or remaining the same?