It’s one of the most dramatic and exciting things in all of sports and entertainment… the famous baseball umpire raising the finger and telling the player/manager, “you’re outta here!!!”

As stock traders, we will need to sometimes act this same way.

Whether you are a premium member of my stock trading community, or someone who simply enjoys the free areas of the community, there is one thing I’m confident you have heard: keep your losing stock trades small and cut them fast.

I understand hearing this over and over again can get annoying, so instead of just “talk-talk-talk” on why this concept is so very important, I figured I should “walk-walk-walk” and show you. It is one thing to preach needing to eliminate your emotions from trading, but it is much more powerful to demonstrate why this is the case.

Stock Trade Time Value of Money

As stock traders, we need to be very aware of the time value of money. What do I mean? The first value of money is what you and I always think of first. This being, the physical money itself. When we are in a losing trade, we are literally losing money. (yup, go ahead and say thank you Capt. Obvious!)

The second value of money, the time value, is what having emotions as a trader can cloud your view of. The time value of money is simply this:

The amount of money we lose because we are spending our time in a losing trade, rather than cutting the loss and then putting that same money into a winning trade.

Instead of trying to explain this concept with words, I am going to use real life examples from the Inner Circle private chat room.

The Stock Trade Scenario

Let’s assume you are in a stock trade that is doing the opposite of what you thought, and therefore is losing you money. You refuse to cut the loss because you choose to spend your time waiting for the price to go back in the direction that will at least allow you to break even.

Chat Room Alert #1, Hillshire Brands Company, ticker symbol HSH.

The first chat room alert came from me at 2:12 pm est alerting a massive fall in HSH’s stock price. As you will see when looking at the chart, the price went on a very crazy run… but one that could have been very profitable.

Crazy run may be a bit of an understatement! After I alerted the stock’s price movement, it dropped down as low as $59.20 and then bounced straight back up to $62.95. The chart above is based on 2-minute candlesticks, meaning, this $3.75 “bounce” happened in the span of only six minutes. How awesome is that?!?!

However, if you were spending your time in a losing trade waiting and waiting, you would have missed out on this bounce trade. Had you just cut your loser fast and kept it small, you would have had no problem not only making up the loss, but putting yourself well into the green on this trade opportunity.

Now… get this… literally ten minutes later, this alert shows up in the trading chat room.

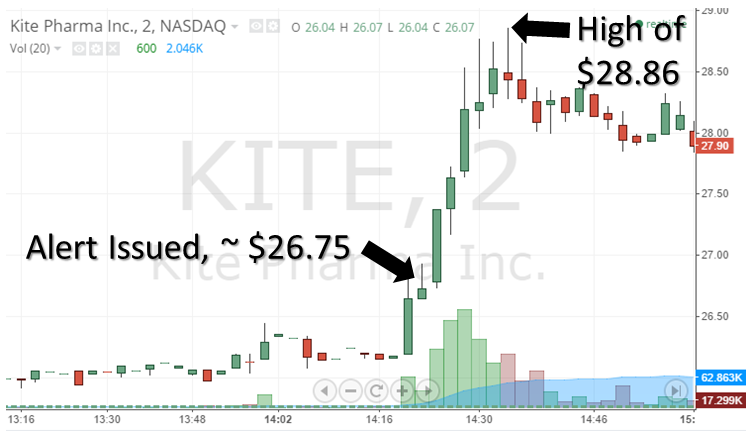

Chat Room Alert #2, Kite Pharma Inc., ticker symbol KITE.

This stock was alerted via another trader in the private chat room due to the fact that volume started to pour in after being mentioned by one of the talking heads on CNBC.

Again, the above chart is using 2-minute candlesticks, so the move from $26.75 up to $28.86 only took 15 minutes… not too bad for a $2.11 jump!

However, if you were spending your time in a losing trade waiting and waiting, you would have missed out on this breakout trade too!

Remember, both of these crazy moving stock alerts came within ten minutes of one another. In other words, from a time value of money perspective, this was a very very expensive ten minutes to have your trading capital not available for use.

Become an Umpire with Your Stock Trades

While you don’t need to always be wearing your umpire hat, when it comes to trading stocks, it is something you should put on before the market opens… always. When a stock does not act how it should within the rules of your trading strategy, you must have no emotion about pointing at the stock and saying, “you’re outta here!!!”

Your trading capital, from a time perspective, is just too valuable to be sitting in a losing trade and missing out on winning opportunities. One of the greatest aspects of the stock market is that fact there are over 5,000 ticker symbols. What’s my point? There will always be another opportunity around the corner, and to spend your time in a loser trade because you refuse to cut the loss is truly a waste of time… and money.

If you are interested in learning how to remove your emotions from trading, and therefore making it easier on yourself to “cut the losers”, then be sure to check out ClayTrader University. You may also join the private trading chat room (where the above alerts were issued in real time) by visiting HERE.