For me, I really learn nothing when a stock trade idea “goes according to the plan”, but I learn the most when I screw up. So that’s what I am going to write about.

I figure this will be kind of like a public trading journal entry for anyone who would like to see it.

How do I feel as I write this at this very moment in time? Frustrated! Not at the stock market, not at technical analysis or chart, not at stock trading in general, but at myself. I made a total bonehead move, and now I’m paying the price for it.

Why am I writing this when it is the middle of the trading day? Because stock trading is all about psychology, and I have entered into the mindset of “I need to redeem myself”. Historically speaking from experience, I know this mindset causes me to do all sorts of dumb things, so I’ve learned to just stop trading for the day. A good nights rest will get me back into the proper trader mindset.

The Broad Scope Stock Trade Idea

First off, this will show how “basic” a trade idea can be. I am not going to sit here and try to pretend like this is some in-depth, highly sophisticated, and/or extremely complicated idea… it is not!

- The stock: Facebook, Inc. (FB)

- Overlying catalyst: $FB accquiring WhatsApp for $19 billion dollars

- Overlying catalyst: $FB downgraded by some (was notified of this in the live stock trade idea chat room… I love that place!)

Because of these things, I…

- Knew the trading (especially in the morning) would be very volatile.

- Due to downgrades, I knew it would be safer to have a bearish bias towards the trade. Just a bias though. If chart showed bullishness, I would play the role of a politician stock trader and change my viewpoint.

The Journey of the $FB Stock Trade Idea

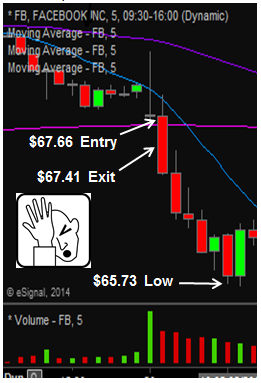

As I expected, the $FB opened with a very crazy first 5-minutes, as you can see by the candlestick and volume bar in the chart below.

(I realize there are no annotations on the chart below; however, if you know how to read a chart, everything I say will make sense. If you do not know how to read a chart, then I hope the remainder of this article will convince you to start learning!)

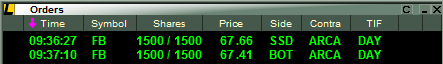

I initially had a short order in up at $68.55; however, the price never hit there, so I needed to readjust my strategy a bit. The next “logical risk” area was at $67.60. This was a key area for the technical chart, so I watched and waited for the break. If if broke, I figured (based on watching the Level 2’s) it would at least for a moment “pop back” up and hit my order.

Sure enough, the chart was spot on and $67.60 broke, and then the price quickly “popped” back up and filled my short order at $67.66.

The Stupidity

Then, for some unknown reason, I started to watch the 1-minute chart which I rarely use. “Why” I threw this time frame chart into my analysis, I have no idea. But doing this was the cause of my problem. In short, I saw some movement on the 1-minute chart that caused me to cover my position at $67.41.

Hindsight is a Great Teacher

First, I am not a greedy person, nor an ungrateful person. Was making $375 in literally less than 60 seconds nice? Absolutely. However, the reason for this article is because I screwed up my entire trade idea, and as you can see below, it cost me dearly.

While I’m certainly not going to tell myself I would have “played it perfectly” and covered my shares at the exact bottom, you can see I left a whole boatload of profit on the table.

To put things into perspective, with my 1,500 shares, I was making (or losing) $15.00 per cent it moved. In this case, it went down 193 cents from my entry… this was a ‘profit window’ of $2,895… and I only captured $375 of it…

Unacceptable…

Lesson Learned

Do not complicate your trade idea with more analysis tools than is needed. Stick with what you know, and trust it.

Was this a stupid mistake? Yes. Was it an inexcusable mistake? Yes.

At the end of the day, if you do something stupid… remember, we all do stupid things, and that includes me! You just need to do whatever you need to do to learn from it.

In my case, I’ve decided to share my stupidity with the world – haha. Maybe that is a bit too much; however, it will serve as a good reminder to myself.

If you are someone who does not know how to read a chart, or does not really use them, you have just witnessed how powerful charts are (I was the reason for the mess up with this trade, it was not the chart’s fault!). Be sure to click HERE to check out the online courses I offer teaching how to use and profit from charts.