It’s been a while since I’ve looked at a fellow member’s trading, so here we are. As I always say in regards to these member case studies, this article will mean more to those of you who are a part of the private trading community. Don’t get me wrong, I hope and believe this article will inspire everyone, regardless of if you are a member or not. For those that are members, I’m assuming you’ve interacted with this member first hand within the chat room which gives it a bit more of realism.

Quick Introduction of the Trader

Who is this member you ask? Our good friend, Shawn, but more commonly known by his chat room alias of dimliwitti. For those of you who are not a member, but perhaps listen to our free weekly podcast, The Stock Trading Reality Podcast, then you have likely already heard his story. You can listen to his free podcast interview HERE.

For you members of ClayTrader University, you’ve also heard from dimliwitti as I have interviewed him in detail about some of his past trades on our live weekly webinars.

Outside of this, if you want to know more about “dim”, as I call him, then you can click on the image and listen to his podcast interview.

I bring all this up because I want to assure you the trade I’m about to discuss is not something that just randomly and luckily happened. Dim has been doing very well and this trade is nothing shocking. Again, for those of you who hang out in the chat room, you understand and witness that Dim is always transparent with his trading. He shows losing days right alongside winning days.

The Power of a Trade Plan

We preach it all the time around here, but unless you have a TRUE trade plan, you are nothing more than a gambler hiding behind the mask of a “trader”. The real-life trade we’re going to look at does a fantastic job of illustrating this very point, particularly in area of not freaking out and keeping a cool head.

I throw out that disclosure because the case study stock, DRYS, we’re looking at dropped $11.09 in less than 2 minutes. You do not need glasses. You read it correctly. The stock’s value went down $11.09 in less than 2 minutes.

This is where I’m circling back to my original point: not freaking out and keeping a cool head. Because Dim had a trade plan based around a logical strategy, he was not only able to keep his cool, but think rationally and make a profitable trade when many would have been freaking out in pure panic (to be fair to these people, I can understand why this would be the case).

Knowing How to Trade Produces Profits

The bars (“candlesticks” as they’re called) each represent 1 minute worth of time. As you see, there are two bars, so yes, in literally 2 minutes the price dropped from a high of $63.81 down to $52.72.

Instead of panicking and losing his mind, Dim watched and found not reason for fear, but reason for happiness because he saw opportunity. This is a big distinction between amateurs and professionals. When the masses feel the emotion of “fear”, the sharks (yes Dim, I’m calling you a shark, but it’s 100% a compliment!) sense the blood in the water and create opportunity for themselves.

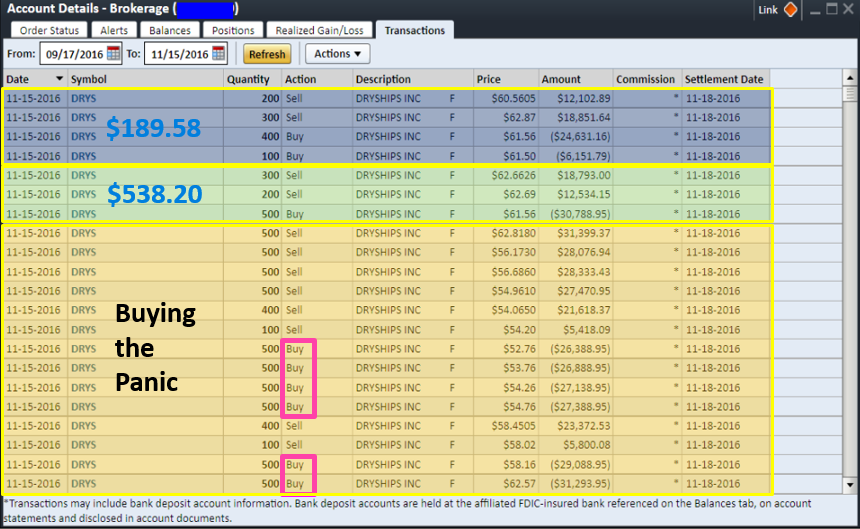

While others were running to the exits, Dim was gladly “buying the panic” as you can see in the screen shot he emailed me. The buys and sells are all mixed together, so I did my best to highlight the buys Dim made.

A few notes about the image below… there are three separate trades there, but the main one we’re focused on is the “Buying the Panic”, therefore those are the buys I chose to highlight via the pink boxes.

By no means am I saying his other two trades were not good, I just wanted to focus on one to hopefully not make this whole case study too complicated.

The Results of the Trading Plan

In the orange box above, you can see how he was “buying the dip” with a cool and calm mindset. Again, please don’t get the wrong impression here. “Just because it is dipping” was not the trade plan. Sure, this was a portion of it, but there were many other attributes too. So, DO NOT go out there and start buying any stock that is falling… unless you want to get slaughtered.

Here’s what happened in a very quick amount of time.

Some poor souls sold and sold and sold and then………. as the image shows, over the span of 10 minutes, the price bottomed out and then headed back up as high as $63.84.

As the green and blue box show us on his transaction log, he did go back for another couple of trades profiting him $538.20 and $189.58, but the big score was right out of the opening gates.

For those of you who are skeptical about all of this, I understand. The internet is a shady place. Dim is also aware of this which is why he sent me all his trade confirmations. If you want to go through them all just for “fun”, you can see the pdf’s by clicking here.

How to Build Your OWN Trade Plans – Self Independence!

As I discussed earlier, what truly separates the amateurs from the professionals is their ability to construct trade plans that allow for them to take advantage of opportunities when others are freaking out and panicking. Well, to do that, you need to first have confidence!

If you are running around collecting “education” from random YouTube videos and the deep dark corners of the internet, I would be willing to bet you do not have any true confidence in what you’re being taught. And rightfully so… I’m guessing you have a voice always questioning “is this even quality information I’m teaching myself?”

Dim is a member of Trading Freedom Pathway, so if you’re interested in being shown how to use technical analysis for trading and to build confidence, and therefore mental toughness like what he is using, you can do so HERE.

If you’re not quite sure the guidance is really what you need, I totally understand. In that case I strongly urge you to check out my free training event HERE.

When all is said and done, if you don’t spend a penny on my site, I genuinely hope this case study has inspired and motivated you to get realistic about the markets and understand that big gains are possible; however, you better have something you can fortify your confidence in. This will ensure that when others are freaking out and running away, you will know how to roll up your sleeves and put together a proper trade plan… all while keeping a cool head.