Did you know that it is possible to be a stock trader who does not pay commission when you are buying and selling the stocks you are trading? Sound too good to be true? I assure you, it is very possible.

I will be the first to admit, whenever I hear about something that is “free to do”, I turn into a huge skeptic. With what I am about to talk about though, I’m actually being conservative in what I’ve said. How so? Well… in all actuality, it is possible to not only learn how to trade stocks commission free, but get paid to trade them!

I will be the first to admit, whenever I hear about something that is “free to do”, I turn into a huge skeptic. With what I am about to talk about though, I’m actually being conservative in what I’ve said. How so? Well… in all actuality, it is possible to not only learn how to trade stocks commission free, but get paid to trade them!

Your Guide to Trading Stocks with No Commission

Can anyone do it? That all depends on the brokerage that you use. Most of the big name online brokerages such as eTrade, Scottrade, TD Ameritrade, Fidelity, etc. do not make this possible.

There are actually two types of “fees”. Those that are of the traditional mindset of “take money away from me”, but, the other type of fee is that which “gives money to me”.

Adding or Removing Liquidity from the Market

The next logical question is what determines if the fees “take” or “give” me money?

It all boils down to whether or not you are “adding liquidity” to the market, or “removing liquidity” from the market. Meaning…

- If you are buying shares “on the ask” and selling shares “on the bid” – you are removing liquidity.

- If you are buying shares “on the bid” and selling shares “on the ask” – you are adding liquidity.

Look at it like this…

- If you take away the opportunity (remove liquidity), the fees take away money from you.

- If you give the opportunity (add liquidity), the fees give you money.

To see the fees that brokerages such as Lightspeed charge, you can look at this routing fee schedule.

A Real Example of “Getting Paid” to Trade Stocks

As I mentioned earlier, I was being conservative when I said “trade without any commissions”, because as you will see with this example, it is possible to “get paid” when you trade stocks through the fees.

In this example, I traded J. C. Penney Company, Inc. (JCP) by shorting. I love to short stocks, so this is a pretty normal transaction for me. Looking below, you can see my trading account after the trade was completed.

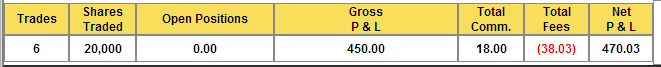

Take note that my Gross P&L from the trade was $450. And then look to the far right column at my Net P & L, you will see that my total profit was $470.03.

In other words, because I gave opportunities to other traders (added liquidity), I was given money in the amount of $38.03. After subtracting out Lightspeed’s fee of $4.50 per trade (total of $18), I was left with an overall profit on all my fees of $20.03.

Ahhhhh! Getting paid to trade… I love it!

See below for a more detailed summary of how all the numbers play out.

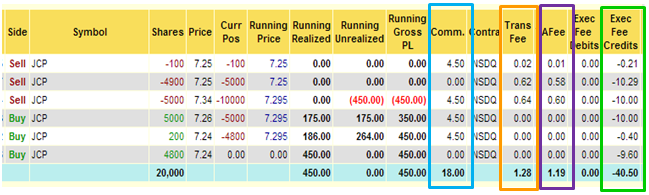

A quick summary of what you see above…

- Blue Box – the normal fee Lightspeed charges of $4.50/trade, total $18.00.

- Orange Box – small minor fee (can not avoid) totaling $1.28.

- Purple Box – small minor fee (can not avoid) totaling $1.19.

- Green Box – a negative fee, meaning, it is being given to me, total $40.50.

Quick math… $40.50 – $18 – $1.28 – $1.19 = $20.03 money given to me.

A Friendly Warning

If you are stock trader who trades large amounts of shares on a daily basis and you are usually removing liquidity from the market, then this whole article does not pertain to you. You will be getting charged additional fees, and therefore, you will “not” be trading for free nor getting paid to trade stocks.

If you are a stock trader whose primary trading strategy is one that adds liquidity to the market, then this article is for you, and I’d highly recommend you do more research into brokerages such as Lightspeed who allow you to “save” money, or in the example above, “make” money as you trade.

I hope you found this perspective on the market useful and interesting. If you are already using this strategy, please feel free to share your thoughts on it in the comment section below. I love hearing from those who read these articles. If this concept is something totally new to you, then again, please leave your thoughts below.