If I were to take a survey based around the question “What does it take to be a successful stock trader?”, I am certain I would get an array of answers given its broadness.

Some answers may be “you need a large portfolio”, “you need to have a solid education”, “you need lots of practice with paper trading”, “you just need to be lucky”, etc. While some of these answers are better than others, they are all wrong.

If you want stock trader success, regardless of if you have not made a single trade, or have made many trades, the sooner you accept this, the better off you will be.

The stock market does not care at all about what you think, believe or hope will happen when trading. It is your boss. When it says “jump”, you say “how high?”

Greed – Where Stock Trader Success Goes to Die

Yea, yea, yea. I already know what you’re going to say, “but Gordon Gekko said “greed is good””. To which I’m going to reply with, “Where did Gordon Gekko end up at in the end of the movie? Jail wasn’t it???”

Stock trader success and greed do not mix well at all. There are two types of greed I’m referring to, the first is the more obvious, but the second is the true silent assassin as you will witness through this article.

Financial Greed – we all know what this one is. “I want to make a million dollars a year and be rich!”

- Emotional Greed – many traders have this mindset (myself included when I began), “If I decide to trade for a living, I am my own boss! No one is going to tell me what to do! That’s the whole point of becoming a full time trader!” This is not the attitude you want to have. Why not? Keep on reading…

Have you ever honestly stopped and thought about “why” greed is so bad? I’m not trying to turn this into a philosophical article or debate, but pausing and figuring out this “why” question is crucially important.

Greed is an emotion that is harmful to stock trader success because it causes traders to perform actions that they have no reason to do, other then the “hope” it will make them more money.

In other words, by using the phrase “high risk” instead of “actions they have no reason to do”, the picture becomes much clearer.

Greed >>> Actions you have no firm reason to perform >>> High/Unnecessary risk >>> Long term loses>>>“Bye bye” trading career/hobby.

How Greed Affected Me as a New Stock Trader

Remembering back to when I first started trading, I can think of multiple instances where I took a risk that was completely unnecessary. The only reason I thought it was necessary was because I wanted more money. It had nothing to do with the odds/probabilities that I would actually make money (favorable risk), but simply, I wanted more money. Can you say greed? (It is very obvious why my stock trader success back then was basically a big fat zero!)

- Ignore Risk – I knew making a certain trade was probably not the wisest move to make, but I rationalized the decision. At times it was because I had not had a winning trade in a while, other times I was coming off of a losing trade and acting out of frustration, or there were points where I was coming off a couple of winning trades causing me to be extremely over confident.

- Unaware of Risk – I genuinely believed something was going to happen that would make me money, but despite what the market was showing me, I still acted on my own belief and continued in my risky ways.

Anyway you slice it, when I first got into the stock market, I was all about making money from home while I sat in my underwear. “How” I made the money didn’t matter, I just wanted to make money by never even needing to get dressed. That is pretty pathetic sounding isn’t it? Well… greed is a nasty thing…

Successful Stock Traders “Listen” 1st, “Take Action” 2nd

Remember who the boss of a successful stock trader is? While they may be self-employed and working from home, they are not their own boss. The market is.

I don’t know about you, but that statement really bothers me. Even now. As someone who always aspired to be (and now is) self-employed, the last thing I want to hear is that I “still” have a boss.

All these feelings are 110% true on my part, but the one difference between myself and many others is I understand this is Emotional Greed showing itself. I want to make this clear, to “have” these feelings is perfectly normal, but to “act” on them is what is going to get you into trouble and lead to Financial Greed.

Put your ego aside, and understand that the stock market is your employer who is cutting you weekly checks; therefore, you need to be a good employee and listen. Once you defeat this portion of your Emotional Greed, you have overcome a large portion of the battle that needs to be fought.

Your #1 goal as a trader is to “time the market” and make your decisions based off of price action. If you want to do this with any hint of consistency, you need to be able to accurately understand what the market is telling you (more on that later).

If the market is “telling you” something, there only way to hear it… and this isn’t rocket science… in order to hear, you must… listen! It is your job to execute the trade in a way that minimizes the financial downside to your portfolio while exposing it to the best profit potential.

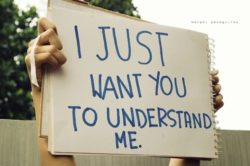

If you are going to do this, you must listen, understand, and then take action.

The Stock Market Makes the Final Decision… with Everything

Before you think I’m exaggerating this point, think about politics. If you don’t think the action of the stock market dictates political agendas/policies/speeches, then you need to remove yourself from the rock you apparently are living under. If the stock market can influence world leaders, then why in the world would it care what you or I believe about something???

If you have any hope at stock trader success, you must not only listen, but you must also avoid the urge to force your set of beliefs upon the market. Again, Emotional Greed has shown itself. And like before, this type of greed ends in Financial Greed which your portfolio does not like.

The sooner you accept the fact that your boss does not care what you think, the closer you will be to defeating this portion of Emotional Greed.

I don’t care how bullish or bearish you are feeling toward a company, sector, CEO, etc., if the price action is opposite of whatever you believe should be happening, then your boss has spoken and you must listen. Of course you can rebel and not listen (Ignore Risk), but I’m confident in saying your “job” will not be with you very long if you choose to ignore your boss.

I enjoy hanging out on message board forums, so I have seen this time and time again (including with myself when I first got started). Traders sit on a sinking ship because they are corrupted by their Emotional Greed which is causing them to ignore their boss and rebel.

The price action of the stock they are holding goes down…down…down… and down some more… yet, they embrace their “belief” and try as hard as they can to force it upon the market, but remember this portion from the rule… the stock market does not care at all about what you think. No matter how hard they try and shove their thoughts and hopes down the market’s throat, they lose money.

The market is the boss and has the final decision. Not you.

“Listening” is Only Half the Battle – Can You “Understand”?

I want to do a quick little recap.

In order to hear what the market is telling you, you must listen which is extremely important; however, that only takes you half way to the prize. If you listen but don’t know how to interrupt what the boss is telling you to do, then you are still going to be stuck in a hole.

I can listen all day long to someone speaking Chinese to me, but if I don’t have a strategy or the training to understand “what” is being said, then I’m pretty useless.

Personally, I have chosen the interpreting tool of technical analysis (the use of stock charts). I hate emotions and have found that charts are a very efficient way to eliminate Emotional Greed. They are extremely effective at accomplishing this because the strategy of technical analysis is structured completely around price action. Ya know? The “thing” we are supposed to be listening to.

With that being the case, the use of charts seems like a clear cut option. If you are interested in learning more about technical analysis, or better yet, ready to make it your interpreting tool of choice, I’d encourage you to check out my instant download educational courses.

Whether you choose technical analysis or one of the forms of fundamental analysis, that is up to you (this is an area where you “are” your own boss), but the fact of the matter is, it is time to acknowledge the market is your ultimate boss who does not care what you think. So listen, understand, and then take action.

Financial Greed – we all know what this one is. “I want to make a million dollars a year and be rich!”

Financial Greed – we all know what this one is. “I want to make a million dollars a year and be rich!”