This content is restricted to CTU members

Today Clay starts out with an example of a very large uptrend with a wolf candle perched at the top. After polling the room for ‘take profit’ strategy. Considering it is a strong up trend but we have a good short signal, we need to be more aggressive in our profit taking. The move showcased in the webinar is not a normal example. We later find out that this is a forex chart further proving a chart is a chart.

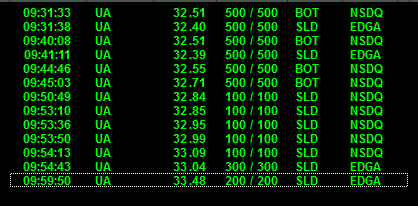

We have a guest on for today’s webinar. Nate Wilson. Ticker UA has a massive gap down due to earnings and he is expecting a high amount of volatility which is what he focuses on. After analyzing the level 2s and seeing many buyers decides to put on a RvR trade to the long side since it was being bought in bulk. He has a small amount of risk and lots of upside. Unfortunately he gets stopped out 5 seconds later for a small loss. He tries another trade in similar fashion due to level 2s and stopped out once again for another small loss. He spots a hammer candle on the 5 minute chart and decided to buy the break of it to the upside. After locating another level of resistance he adds to his position. Since his original stop loss was in place, he sprinkled out 5 orders to take profit and close half his position. After about 5 minutes, 4 of those targets are reached. He broke his stop loss into two orders and had one very aggressive one. Now he is down to 300 shares with about a dollar cushion from his entry. We see that he gets almost another dollar in his remaining shares before being stopped out which completely wipes out those two smaller losses from earlier. This is the power of risk vs reward.