last updated: April 2022

Before anything else, I want to first start off by making sure you are not falling into one of the biggest traps out there for new traders. The trap being, the first thing I need to do as a newer trader is sign up for an online broker. I get it. You want to be a trader. In order to be a trader, you need an online broker – therefore, the first thing you need to do is open a broker account.

This is 100% logical, but unfortunately in the world of trading, the logical thing to do is not always the right thing to do. Believe it or not, opening an online brokerage account is one of the last things you should be doing.

Like any profession, you first need an overall understanding of how it all works, and then as you get a narrower understanding, you’ll begin to see the finer details. The finer details in the world of trading are things such as the broker you choose to use. Would you give a loaded gun to a child? Of course not! So why would it make sense to have a brokerage account as a “child” when you don’t know what you’re truly doing? Another way to view this concept can be seen in this analogy video below.

If you are reading this, then you are not “brand new” as I define in the above video.

If you did not watch the above video, and you’re still just plowing along, NEWS FLASH, you are cutting corners. This is NOT something you want to get in the habit of doing as I explain HERE.

At this point I am assuming you’re not brand new… so let’s continue our journey into figuring out what broker best fits you. I am going to first start with a non-negotiable rule. After this, I will guide you through some questions you should ask yourself in order to best determine what broker fits your needs

The Non-Negotiable Rule

Given we live in an amazing time of technology, the first point of this guide that must be addressed: online broker. The “old school movie” way of calling in your orders to a broker are done. I don’t care if you are intimidated by computers and the internet, it’s time to learn! It will pay you.

What do I mean it will pay you?

I will be using this theme/logic throughout the guide, so I might as well address it now. One of my favorite quotes comes from Benjamin Franklin when he says,

A penny saved is a penny earned.

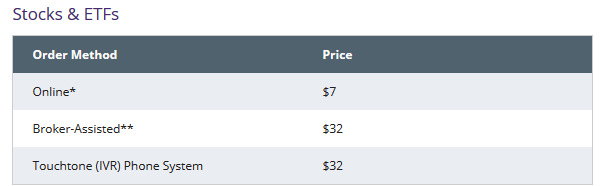

Keeping this quote in mind, you should see why you NEED to use an online broker. Check out the below screen shot taken from one of the well-known online brokers. (The actual broker does not matter because what you see below is a universal fee structure.)

- To trade a stock online: $7.

- To go the old school route of calling in to speak with a broker: $32.

In other words, by using the online order placement method, you are “saving” (and therefore “earning”) $25 right off the start! Another way to look at it, you are saving 78% of your money by NOT using the “Broker Assisted” route. This is pure craziness! I hope you will agree with me that there should be zero debate or negotiation about this rule. Use the internet to place your orders. It’s as simple as that and it’s not an opinion, it’s a mathematical fact.

Let’s now move into a series of questions you should ask yourself. By doing so, you will ensure you guide yourself to a broker that makes the most sense for your goals and strategy.

Question #1: “What Do I Want to Get Involved With?”

There are many areas in the markets, so simply telling yourself that you want to “trade the markets” is way too broad. By being so broad, you are opening yourself up to the risk of choosing the wrong broker.

What area of the market do you want to get involved with and trade?

- Stock

- Bonds

- Options

- Currencies

- Commodities

- Futures

- Crypto-currencies?

Perhaps you’re thinking you want to do a mix, that’s fine. You still need to choose one area of the market that you believe will be your “go-to” strategy and base your broker selection off that. For example, if you know you really want to trade stocks, but also find option trading interesting, then focus on finding a stock friendly broker who also offers option trading in some aspect (which is quite normal to be able to find).

To keep this guide simple and efficient, I will only be discussing brokers for stocks and options.

Question #2: “How Active in the Markets Will I Be?”

If you are not sure, then no worries, it is not the end of the world. Remember, you can always change brokers if you need to, although let’s do our best to avoid that hassle from the start.

How am I defining “active”?

If you do 3 trades* or less during a week, so 12 or less during a month, then I would consider you a non-active trader. (trade = buying and selling the same stock/option within that same week)

Non-Active Trader (Investor)

M1 Finance is my number 1 choice when it comes to a broker for investing. They sound too good to be true on the surface, but they are legitimate.

Not only does M1 Finance offer $0 commissions, but they also allow you to buy partial shares (which is a huge plus). On top of this, they offer tax friendly accounts which others (such as Robinhood) do not offer. Over the long term (“investing”), tax friendly structures and partial share purchases add up in big and efficient ways!

CLICK HERE to see a more in depth review sign up using my link so you can get $10! (full disclosure, I also will get $10.)

Active Trader (Day-Trader/Swing-Trader)

If you plan on doing more than 3 trades per week, then I would consider you someone who really wants to be active in the markets. With this being the case, you need to be more focused on commissions since you will be doing a much larger volume of trades. This is where things get a bit tricky, so you will need to ask yourself a final, but very important question.

Question #3: “How Much Money Will I Be Using?”

If you are still reading, you should be someone who already is, or plans on being an active trader, so with that in mind, let’s look at what I would suggest.

$25,000 or More

In this case, as far as I’m concerned, you have two choices.

Neither is commission free; however, when you’re at the “over $25,000 level”, you need to be focused first and foremost on execution speeds and the ability to be extremely flexible within your trading. Both brokers allow for this.

One is a tad cheaper than the other; however, they are close enough to just say, “Choose what you like best in terms of personal feel.”

The two choices…

$10,000 or Less (Stock Focused)

If you want the entire package as a trader, then WeBull is the broker to use. Oh yeah, the whole $0 commission and $0 platform fees is quite attractive as well! A common question I get is:

Why WeBull over Robinhood?

As far as the phone app is concerned, I will be fair… WeBull and Robinhood are equal. However, when it comes to the platform that you can use on your computer/tablet/etc., WeBull wins by a mile and is the reason why I would recommend them over Robinhood. The cherry on top for someone like myself who relies upon technical charts to make my trading decisions, WeBull offers some very respectable charts as part of their online platform.

By CLICKING HERE and signing up, and depositing only $100 into your account, you will receive a free stock from WeBull as a “thank you”. (full disclosure: I also will receive compensation)

$10,000 or Less (Options Focused)

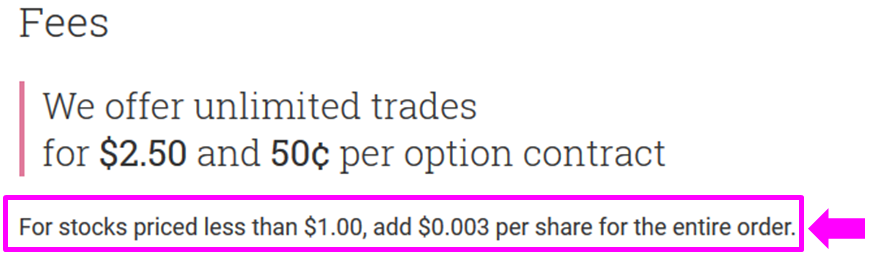

When it comes to those of you wanting to focus on option trading, there are lots of things to like with TastyWorks. You can see their very favorable commission structure in the image below. With no minimum funding requirements for a cash account and only $2,000 for a margin account, you really can’t go that wrong.

While the charting features may not be complex, they have every indicator that most of us in the ClayTrader community use including moving averages and various oscillators. The platform is also extremely lightweight for those of you on older computers or laptop users. You can find out more information and open an account here.

Potential Questions & Considerations

While on your quest for a broker, the above three questions are going to be the “Big 3”; however, depending on your situation, there may be some other aspects you need to consider. I want to quickly address each of these that seem to be common from my experience in coaching traders since 2013.

International Traders

I really wish I could get into each and every countries choice for online brokers, but that is just not reality. Assuming you would like to trade the US Markets; Interactive Brokers is going to be your best bet, no matter what country you are in. They by far have the widest international customer service.

Penny Stock Trading

The easiest way to approach this is to just yell, READ THE FINE PRINT! This is a broker by broker issue as they all have different policies towards this, but when you are looking at the commission/pricing, get out your magnifying glass to read those tiny words.

As an example, here is one broker’s pricing page…

To give this broker credit, they make it very easy to see, but just be warned, not all brokers have it this “clear” when it comes to their penny stock policy. If you are looking at a penny stock and plan on buying 20,000 shares of it, just know that your commission will be $60. In other words, if you want to trade penny stocks, the above broker I used as an example is not going to be the broker for you.

How do I Avoid the Pattern Day Trader Rule (PDT)?

Many new traders ask (rightfully so, it’s a good question) which broker they should use to avoid the pattern day trader rule. The answer:

it has nothing to do with the brokers as it is a US Government regulation.

While some may direct you to “other” brokers to encourage you to get around the rule, I will never recommend to anyone an off-shore broker. If you want to put a bulls-eye on your back for the IRS, then be my guest, but you did NOT hear it from me to do such a thing. If you are annoyed by this rule, there are some ways to avoid it by getting creative (all perfectly legal) which I talk about in this free video.

Is this Person Getting Paid to Recommend? (Affiliate Marketing)

This absolutely needs to be a question you are asking yourself.

Now, as I’ve already fully disclosed, I am indeed receiving a compensation if you sign up for some of my recommendations; however, every broker I have recommend is onshore AND are registered with all local governing authorities.

- If, while doing your research, you come across someone talking about a broker that you’ve never heard of, be a bit skeptical.

- Is this broker registered with the proper authorities such as FINRA?

There are some very shady/crappy/moronic brokers out there that are being recommended, for the simple fact that the person recommending them gets paid if you sign up, so be aware. Granted, this is much more common within the world of Forex brokers and cryptocurrency brokers, but it can still happen with stocks and options.

Trading Tools to Use

There is no right or wrong answer here, it is purely a matter of what “makes sense” to you and helps you to remove emotions from your trading. For some people, it is all about the fundamental analysis and looking at projections and balance sheets. If you are in this camp, then the good news is, the internet is your friend and you have plenty of resources available to you.

If you are like me, and choose to use technical analysis (the use of price charts), then it gets a tad more tricky, but is not terrible. Most brokers have price charts included with their platform, but in the event you do not like their offerings, there are many third-party chart providers.

To learn more about this, GO HERE and see the video I did talking about some of the best technical analysis software available.

Online Trading Broker vs. Phone App (What is Better?)

When I first got started in day trading and investing, there were no such choices as apps to download onto your smart phone.

If I step back and put myself into a beginner’s shoes who is brand new to the financial markets, I could see myself being a bit confused between an online trading broker and an app for my phone. The good news is, they are one in the same!

The proper wording and terminology would be:

An online trading broker offers their customers not only a platform for their PC, tablet, etc. to trade and invest into stocks, but also an app that can be downloaded onto their phone to do the same.

In other words, there is no choice that needs to be made between the two tools. The wording can get confusing but they both do the exact same thing.

An Invite To My Free (and Live) Online Training

If you’re in the early stages of wanting to start trading online, don’t worry – I’ve got a free class for you that you can sign up for RIGHT NOW – no waiting!

This is a live class (not a recorded video) so you can be interactive with me and ask any questions you have.

The 1 Hour Trader Transformation is a 90-minute class that reveals how I transformed myself from an employee to being my own boss (and how you can too, even if you don’t have any experience).

Here’s what I will show you on this free online class:

- How to Quickly Clarify and Transform Your Mindset With This Weird Trick

- How to Quickly Build Confidence Using A Skill We Naturally Have Within Our DNA As Humans (literally!)

- How to STOP Working Hard and START Being Productive As A Trader