When it comes to trading and education the one thing I’ve learned since starting this site is how much people enjoy hearing about other people’s journey. Whether that be via The Stock Trading Reality Podcast or one of the numerous blog articles on the site, people like ‘reality’, not ‘the theory’ of things.

As someone who enjoys showing others how to trade; I always enjoy the real life examples that provide realistic learning points. I mean, don’t get me wrong, it’s sort of cool to read about someone who wins the lottery and gets rich overnight, but I’m not sure what can be learned from a realistic vantage point. Want to make lots of money in a quick amount of time? Go play the lottery. Uhhhh, not sure how practical that actually is… haha!

A Real Life Example of Trading Education Working

A few days ago I received an email from a member. While there is certainly nothing flashy about it, the learning points are the true backbone to gaining traction and success as a trader.

I want to just break down the email and go over some of the important aspects that can be learned from this person who is just like you or I. Like I always say, if you’re looking for some kind of late night infomercial success story where someone is making millions of dollars after one week of trading, save yourself time and stop reading now.

The email…

This first section of the email offers so much golden insights I could write numerous blog articles on it, but I’ll keep it bullet pointed.

Key Point #1: Trading Takes Time

“Member for about 6 months” …

As you read, this member has been spending time learning for “about 6 months”. Yeah, you read that right… basically half of a year. You know what? It’s the truth. If you think that this trading thing can be mastered in a few weeks, you’re delusional.

Key Point #2: No Room for Excuses

“I work a day job” …

Got a job? Got a busy life in general? That’s no excuse. I’ve lost count over the number of times I’ve heard people use the justification that “because they are busy” it is okay for them to just skip over the whole learning part and just start using real money. It makes no sense, but it happens all the time. It’s time to expose the excuses and just make it happen!

Key Point #3: There is No Need to Rush!

“learning is going slow” …

Listen, despite what some doom-and-gloomers may have you believe, the markets are not going anywhere. They’ve been around for over a 100 years and will continue to do so. “Learning is going slow” is perfectly fine and in all actuality, how it should be! Way too many people invest into education, which is awesome, but then they rush through it and wonder why they’re still inconsistent in their trading.

Key Point #4: Emotions Will Always Be There

“I found myself in two emotional situations” …

I’m well aware that my slogan is “Trade Without Emotion”. But you know what? Emotions are always going to be part of the battle we as traders face. The sooner you accept that; the sooner you can move onto realizing how important it is to provide a solution to yourself that will ease the problem.

Key Point #5: The Importance of Having a Solution

“I asked myself, what does technical analysis say” …

Because I sell training on how to use technical analysis in trading, I’ll be honest, I’d really love to sit here and proclaim that you MUST learn how to use charts and it is the ONLY way… but, it’s NOT the ‘only way’. The idea here goes back to Key Point #4 and the problem it (emotions) presents. You must have some sort of solution to ease the problem. For me personally, I use technical analysis (use of charts), but there are other ways out there. The point here is not that you must use charts, it is that you must have a solution to the problem. And just so you know, treating trading as Las Vegas is NOT an adequate solution.

Key Point #6: The Power of a Solution

“I wasn’t sure when to exit, but the chart told me when to exit” …

Not knowing what to do is totally normal. Heck, it happens to me every day as there is no crystal ball in the markets. The difference is that I have a solution to this: a strategy. Again, I’m not telling you that you MUST use charts, but the point here is that when you do have a solution (aka a strategy), you are able to overcome the hurdle of “not knowing what to do”. We are all just making educated guesses in the world of the stock market (Warren Buffet included), but the key word is “educated”.

Key Point #7: Self Awareness is Crucial

“would have chased some penny stock crap” …

The translation here is: I would have gambled with my money. It may seem like not a big deal, but when you become self-aware and understand yourself, you know where your pitfalls await. And when you know “where” they are, you know that you better take a different path to avoid them.

Key Point #8: Beating the “Slow and Steady” Dead Horse

“I’m going slow” …

Nothing new to say here other than to repeat myself. The markets are NOT going anywhere. Take your time.

Key Point #9: Hard Work & Time Pay Off

“I’m in the black” …

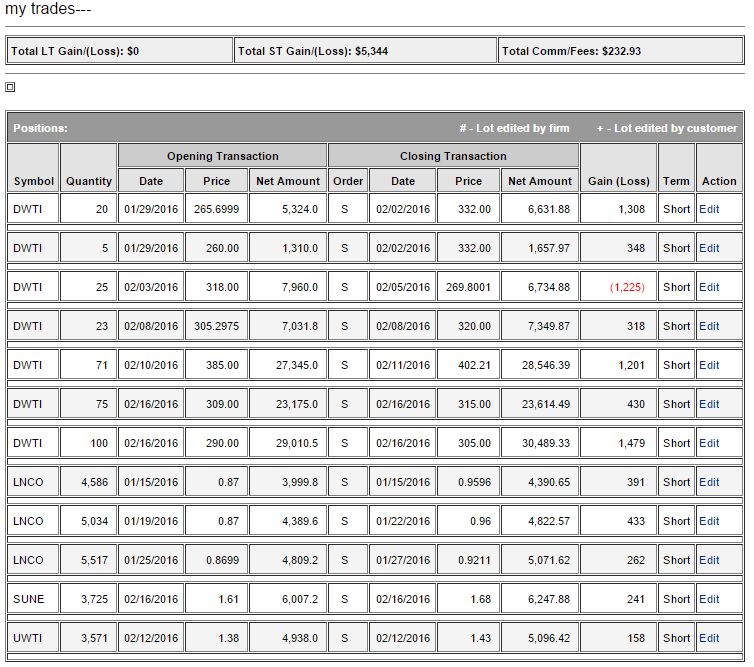

It hasn’t been a quick journey for this member. It hasn’t been easy either when they’re working a lot due to their day job. But at the time of this post, 2016 is off to a solid start as you can see below. Before you look, let’s keep this fact in context. This person has a full time job, so the income you see is just “fun money” they are creating for themselves. $5,000 in less than two months’ time? Not too shabby.

If this isn’t slow and steady wins the race, then I don’t know what is. The part that makes me feel good is they now have over a 100% gain on their investment with me. My entire training program costs $2,497, and this person has now not only paid for the program, but added another $1,500 on top of it. I love it! Knowledge pays a great dividend and this is a perfect example of it.

I hope this motivates you in the sense that if you feel like your progress is moving upwards, but just in a very slow way, then that’s great! That’s how it is supposed to be! Please don’t feel like you need to rush yourself. Whether or not you invest a dime into my training is not the point, the key point here is that becoming a successful trader does not happen overnight and it is a goal that really has no room for excuses.

So throw the excuses aside and get out there and start the slow and steady race to becoming a consistent and profitable trader!