I wanted to quick write this blog article as a reminder to myself more than anything else. If you’ve been around the blog for a while, you know I tend to “talk to myself” via some of these articles. In this case, there is a very valuable lesson/reminder involved.

The lesson is short and sweet: patience pays.

The problem here (again, speaking to myself, but I have a feeling many can relate) is that while, sure, the principle/rule is short and sweet, that does not mean it is easy to follow.

I had a reminder of this recently, so I wanted to walk through it step-by-step so we can all be on the same page of how this principle actually works and unfolds in the “real world”.

Defining Patience

I need to first define patience due to the fact that the word is one that has been corrupted and misused in so many ways within the world of trading.

I am NOT defining patience as…

“Investor Patience” – be patient in the long term with your blue chip stocks because dividends and the power of compounding are in your favor. Just be patient and let the math be your friend.

“Investor Patience” – be patient in the long term with your blue chip stocks because dividends and the power of compounding are in your favor. Just be patient and let the math be your friend.

“Penny Stock/Amateur Patience” – be patient because you got a bad entry point, but don’t worry… it’s a great company and will eventually come back up. Heck, maybe even buy some more and then be patient and wait. (Side note: if you are not realizing I’m saying this tongue-in-cheek, then please realize you are a sheep)

I AM defining patience as…

“Disciplined Trader Patience” – be patient and realize you don’t always need to be in a trade. Realize there are thousands of ticker symbols floating around and that there will always be another opportunity. In fact, your favorite order type is found here.

My Recent “Disciplined Trader Patience” Journey

Let’s first start with some overall context.

This all happened on a Tuesday. On Monday, I did not get any fills on my set-ups leaving me with literally zero trades on the day. Frustrating, yes… but not the end of the world.

Now it’s Tuesday and the morning session (first 90 minutes of day) is over…. and guess what? I have zero trades.

This is where the whole “patience pays” rule starts to get very fuzzy. My mind began playing games with me and was totally using the weekend as leverage. Meaning, the voices were making it seem like it had been FOREVER since I’d made a trade. What the voices were not telling me was the fact that Saturday and Sunday I couldn’t trade anyways, regardless, due to the weekend and now where I was at mentally, it felt like an eternity since my last trade!

Around 11 am est., I was talking to fellow member of the chat room/friend, Nate Wilson (listen to his podcast HERE), on the phone about something unrelated to the market. As he can attest, I started to throw a pity party for myself about how I had zero trades. Not only “today”, but also the day before… I was getting VERY frustrated at this point.

Not to make myself sound like a perfect trader, because I am by no means perfect, but to my credit… while I was upset, yes, I was not forcing any trades and was being patient. I clearly did not have the best attitude about being patient, but I was being patient nonetheless.

HMNY, My Knight in Shining Armor, Arrives

As Nate and I are talking on the phone, ticker symbol HMNY begins to trade in a way that both of us enjoy (we have very similar strategies). Him and I watch it, discuss it, and then both eventually put in entry orders… in case you’re wondering, they were both at different locations.

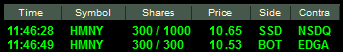

This is what then followed… (all done via “shorting” – not sure what that is? Click here – in a nutshell, it allows traders to make money when prices go down)

If you look in the “Shares” column, you’ll see I wanted to short 1,000 shares. The market only gave me 300 shares. The voices in my head jumped all over me and tried to make me feel like it was a losing trade and that I needed to “get revenge on the stock”. This of course was a bold face lie, I had actually made $36 on it. Would I have made more had I gotten an entire fill of 1,00 shares? Yes. But it was STILL a winning trade.

I bring this up because it does a great job illustrating just how tricky these voices can be. They (the voices) know what you are supposed to be doing, therefore they will try and turn it against you. This is how it went in this instance…

Clay! What the heck?!?! You’ve been being such a patient trader over the past four days (remember, two of those days were the weekend – haha – scumbag voices!), yet when you finally get the trade you want, the market rewards you for your excellent patience by only giving you 300 shares when you wanted 1,000?!?! What kind of garbage is that?!?! It’s time to be a man and show this stock who’s the boss! Get back in the trade, NOW!

The voices know the rule of “patience pays”, so as you hopefully saw, they grabbed onto that and tried the good ol’ fashioned Jedi Mind Trick on me. I really hope some of you reading this can relate… if not, maybe I’m just crazy? Anyways…

I kept my cool, and didn’t force any trades, and just kept at it from the short side….

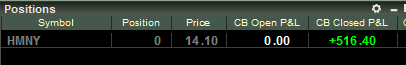

The crazy part about this was I had zero trades, and then, in the time span (notice those boxes) of less than an hour, I had made this much…

From a point of total mental frustration and bitterness to the point of throwing a little pity party for myself to then being up over $500… the market is a roller coaster no doubt!

Trading Lessons to Remember and/or Learn

Here are few things that I know I took away from this miniature journey, and hopefully some things you took notice of.

- Literally, there are thousands of tickers in the market. No need to rush into anything or force a trade. Be patient and your knight in shining armor will eventually arrive.

- Let the market come to you. You’re the boss. Yes, there are a whole TON of things in the market that you cannot control, but one of the things you have TOTAL CONTROL over is whether or not you take a trade.

- Be aware of the voices in your head and their tactics. Namely, taking what they know you should be doing and then twisting that in a way which is not beneficial for your well-being as a trader.

Being frustrated is perfectly normal and part of being a trader. Feeling frustration is not going to cause you harm, but acting on frustration is what gets traders in trouble. Remember, it’s not the “feeling” it’s the “acting”.

I hope you can relate to the emotions I was dealing with on this journey. Even more so, I hope you can benefit from it by realizing that with enough patience and diligence, it’s only a matter of time before a knight in shining armor shows up to rescue you from the evil voices in your mind.

If you are interested in learning more about the core of my trading, I offer multiple training modules. Perhaps you’re simply looking for a non “pump-and-dump” chat room to join, I hope you consider joining our team… I mean come on, $99 for 12 months? I’m quite confident you’ll gain at least $99 worth of value over the time span of 12 months!

Thanks again for hearing me out as I blabbed to myself in this article! If you can relate to this in any way, please share your experience/story with us in the comment section below.