I am writing this blog article for two reasons. The first has nothing to do with you, the reader. It solely deals with me. Let’s just call it my personal diary entry. I need/want to remind myself of this very important lesson, which as you will see, was quite costly.

I figured while I’m at it making note of this stupid mistake on my part, I might as well make it as educational friendly as possible. What I’m about to talk about is truly at the backbone of my trading… this is why this mistake on my part stings much more than some of my other boneheaded errors.

The broader/general concept of this trading ideal is explained in the video HERE, but in this article, I want to write about a specific example (which, unfortunately happened in real life…ugh).

The Trading Ideal I Believe In

Trade what you see happening, NOT what you think will happen.

Again, “why” I believe in this ideal along with the favorable risk vs. reward it presents can be explained in THIS VIDEO, but for the point of this article, I just want use a real life example which illustrates this concept.

The $SPY Options Trade Set-Up

This concept applies to everything: Stocks, options, forex, futures, commodities, etc. In this particular example, I was “trading” (I use that term loosely given how boneheaded I was) an option for SPDR S&P 500 ETF (SPY).

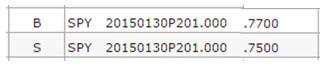

Using the reverse chasing tool (which is taught within Trading Freedom Pathway) I decided to pick up some $SPY Put Contracts for $.77 each (translation: if the price of SPY goes down, my option value will rise).

The Costly ASSumption Happens

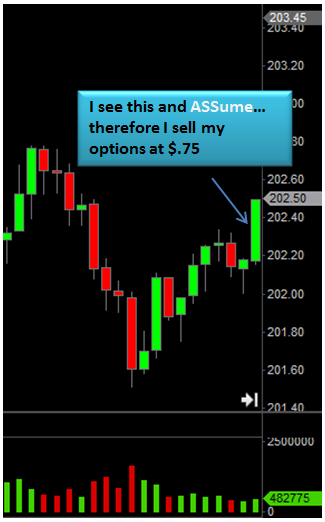

Remember, I can only make money with my options if the price of $SPY goes down. Looking below, you can see a big ole green candlestick has formed. Not exactly what I wanted to see; HOWEVER, despite the upwards price action, my trading plan was still in play.

What was not in play was my mind. I decided to “think” (ASSume) that the price was going to continue to rise, and therefore I would be stopped out, so my throught process went something like this…

I might as well take the loser right now and keep it a bit smaller.

The extra stupid thing about this is the loss (“if” it even occurred) was never going to be big in the first place due to my rules of risk management. So, not only was my trade plan still in play, my risk management rules were in place… I literally had no reason to sell other than “thinking” (ASSuming) that the price would keep rising and therefore stop me out. With this ASSumption, I sold at $.75 for a $.02 loss on my contracts.

The $SPY Options Trade Aftermath

My original trade idea was that the price of $SPY would go down (and therefore my options would increase in value), and as you can see in the chart below… I was right. But thanks to me breaking the backbone principle of trading what I “see” instead of what I “think”, I not only took a loss on the trade, I missed out on massive gains.

What kind of possible gains did I cost myself by ASSuming? Time to rub some salt into my wounds….

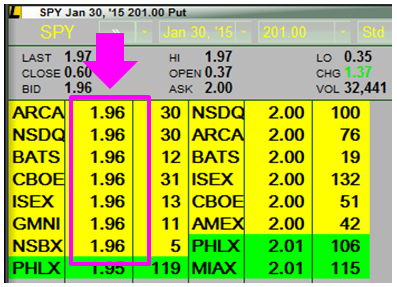

From a day trading perspective, the highest I could have sold for (if I played it perfectly) was $1.96. Or in other words, a gain of 155%!!!

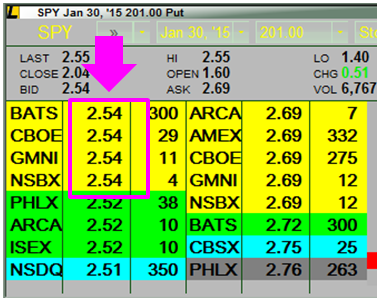

From a swing trading perspective (if I had held a portion of my position overnight), the highest I could have sold for (if I played it perfectly) was $2.54. Or in other words, a gain of 230%!!!

I certainly would not have played either of these perfect, but that’s beside the point. Having opportunity windows the sizes of 155% and 230% to pull profits out of is a very attractive situation…. And, thanks to me trading based of what I “think” instead of what I “see”, I completely removed myself from this attractive situation.

Learn From this Loser

I don’t care what you’re trading… bonds, stocks, options, futures, currencies, baseball cards… when you “think” instead of “see”, you are opening up your trading plans to massive mistakes. Sure, at times you’ll be right in your assumption, but the amount you save on the loser will be nothing compared to the potential winnings which I sacrificed in this example.

Is this example embarrassing to talk about? Yeah, it is. But it is real. It’s very annoying to see so many people out there only talk/blog about their winners. I swear, the majority of traders on social media, blogs and message boards seem to never make mistakes or having losing trades – haha. In all seriousness, I hope this has helped you realize how dangerous ASSuming (“thinking”) can be when you already have a plan in place.

Is this example embarrassing to talk about? Yeah, it is. But it is real. It’s very annoying to see so many people out there only talk/blog about their winners. I swear, the majority of traders on social media, blogs and message boards seem to never make mistakes or having losing trades – haha. In all seriousness, I hope this has helped you realize how dangerous ASSuming (“thinking”) can be when you already have a plan in place.

I’d love to hear about any experiences you’ve had in regards to ASSuming a trade plan. Please leave any stories below in the comments. I think it’d be that much more effective if we collected a nice archive of trades made via “thinking” instead of “seeing”.