I write this more for myself as both a diary/reminder of the stupidity I allowed myself into, but I figured, why not share it in public? As embarrassing as writing about how I ruined my trading month is, I figure if someone can learn from my mistakes, then that is awesome.

write this more for myself as both a diary/reminder of the stupidity I allowed myself into, but I figured, why not share it in public? As embarrassing as writing about how I ruined my trading month is, I figure if someone can learn from my mistakes, then that is awesome.

If you’re in the business of looking for some well-spoken and grammatically perfect article, then ummmm yeah… might want to stop reading now!

The Rule that was Broken

Crossing out Plan A and writing Plan B on a blackboard.

I’m not going to get into all the nitty-gritty details since that is not the point of this write-up, but this rule that was broken has nothing to do with trading at all. I think this is why I allowed myself to break the rule in the first place… I believe I somehow thought that because this was a rule for “investing”, the rule was different. I don’t know if this is making sense to you as the reader, but it was almost like I reinvented the definition of “rule” because it didn’t pertain to “trading”, but rather, “investing”.

Again, I’m not going into massive detail about my long term investing/retirement rules, but the core of my rules revolves around “boring” stocks. Ya know? The ones that have been around a long time, pay dividends, and have proven themselves over not a few years, but decades.

The Investment I Thought was a Good Choice

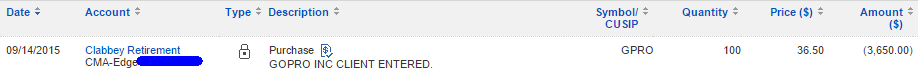

A picture is worth a thousand words, so let’s go down this journey of dumbness…

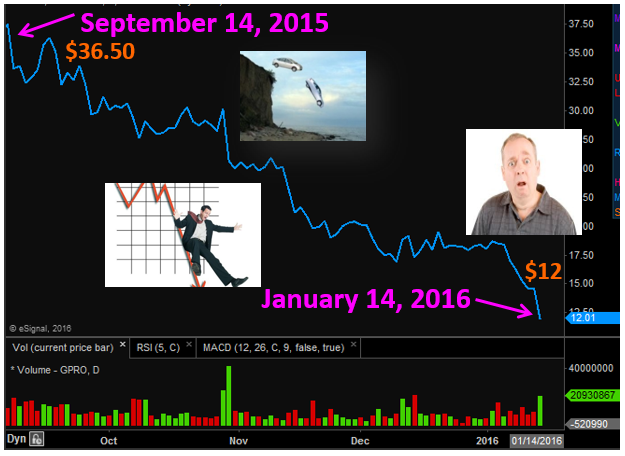

September 14, 2015

This is the day I did this…

Yeah, you’re reading that ticker symbol right: GPRO, as in GoPro, Inc. the camera company. Perhaps you are thinking, “geeze Clay, they’ve been around for a few years, yes, but been around decades? Not even close!” Exactly!!!! Yet, I went ahead and put $3,650 into it for a cool 100 shares.

I followed the bright lights of a sexy tech /speculative stock (that pays zero dividend I should add) down the rabbit hole of rule breaking. At the time of the purchase, the GPRO technical stock chart appeared as you see below (just using a line chart so traders unfamiliar with candlestick charts can understand what is going on).

My rationale for breaking the rules was “Wow! GPRO is now at $36.50… it was just at$60 four weeks ago, and a few months prior to that, it was up in the $90’s!”

Let’s fast forward to today (the day I am writing this and the day I sold my 100 “cool” shares).

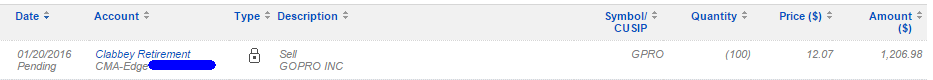

January 14, 2016

This is the day I did this…

That $3,650 “investment” I made was now worth a “cool” $1,207… And you know what? Maybe I sold the bottom. At this point in time, I have no idea if this was the right move; however, in all honesty, I hope I did sell right at the bottom. That would make this experience sting that much more, and it’d be a painful, yet powerful, reminder to not break rules that place me in positions of “could I be selling the bottom?”

The One Good Decision I Made

Don’t get me wrong, this was still a very ugly loss, but thanks to the power of advanced options, and more specifically covered calls, I was able to soften the damage a bit. Below you can see all the money I made using this options strategy.

One quick note, as I’ve already mentioned, I’m doing this blog the day I sold. One of my option sales from today has not shown up yet in the records, but was good for another $179.59 in profit. When added to what you see above the total is: $855.72

The Final Math & Conclusions

When all the dust had settled from this rule-break-investment, it looked like this.

Total Bought: $3,650

Total Sold: $1,207

Gain/Loss: $1,207 – $3,650 = $2,443 loss

Covered Call Income Generated: $855.72 income

$2,443 loss – $855.72 income = $1,587.28 actual loss

Ouch!!! I broke the rules. I paid the price with cold hard cash.

Now, do I think I can recover this loss over the next 35-40 years of retirement investing? I sure hope so! But one thing is now abundantly clear to me. If I keep breaking my investment rules, “where I stand” 40 years from now will look a lot different, in a bad way, then what I’m planning on.

Whether you are trading, investing, playing a sport, playing a board game, or whatever else… breaking the rules more times than not does not give good outcomes. Stick to your rules!!! Follow the system!!! (I’m not really yelling at you here, I’m yelling at myself… remember, this is like a little diary entry for me)

Outside of the lesson of following your rules, I hope you also witnessed the power of advanced option trading. This by no means is a sale pitch blog article, but if you are interested in learning how to use advanced options for things such as you saw in this article (they have MUCH MORE flexibility than just this one example of covered calls), I offer a course here that will show you how to use them to your advantage (that’s all I’ll say about it).

If you have any examples of investments/trades where you broke the rules and want to publicly display them, please do so in the comment section below. I’m confident it would serve as a good reminder to us all as to the pitfalls of breaking the rules of whatever system/strategy we are telling ourselves we need to follow.

Thanks for listening to me yell at myself. I hope you gained at least a tad bit of value out of this :).