The big question I have received ever since the release of my Options Trading Simplified training course revolves around my private trading group chatroom and whether or not we “talk options”.

I decided I needed to work smarter not harder, so instead of typing up an email to respond, I can simply send them the link to this blog post.

To answer the question: yes, we do cover options trading in the chatroom. I figure the best way to illustrate this is to use an actual alert from the chatroom.

The Context of the Options Alert

We are all about technical trading (using chart analysis) in the chatroom, so after I noticed the Netflix, Inc. (NFLX) forming this set-up…

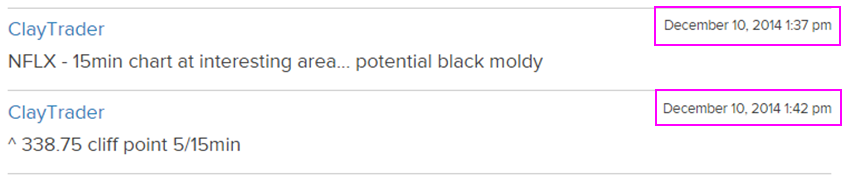

therefore, I made the following alert to the chatroom…

Unless you have taken my options trading course, you’re probably thinking, “What does black moldy mean?” Simply put, that is just some terminology I use in the options course. Like any good and efficient trading floor, terminology must be used in order to explain larger concepts in just a few words.

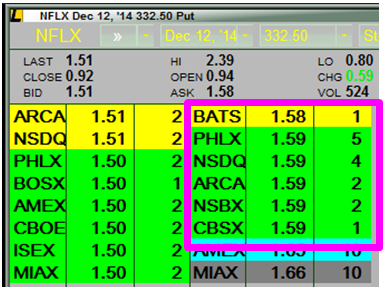

At the time of this alert, the options for $NFLX presented this opportunity…

Buying at $1.58 probably isn’t the most realistic entry, so we’ll just base the calculations off of a much more realist entry point of $1.59. For those of you who may be unfamiliar with options, this goes show how flexible options allow you to be. The minimum amount needed to get involved in this trade was $159 (keep in mind, $NFLX the actual stock was trading for over $335 at this time).

How the Options Alert Played Out

Over the next two and a half hours, the price of $NFLX’s stock drifted down and down – going as low as $333.66.

You may be thinking, how could money have been made if the price of $NFLX stock went down? Well, once again, that shows the power of options trading. Whether prices go up or down, as you will see, options still allow you to pull profit from the markets.

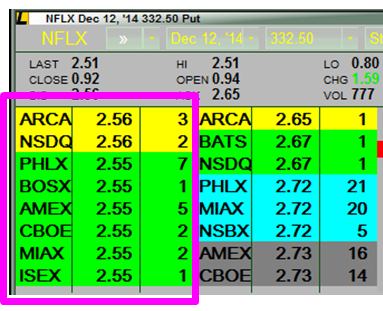

The frustrating thing here was that I was away from my computer when the stock hit the lows of $333.66, so I was not able to get a screen shot of how high the option value increased. The best I could get was this…

Despite me not capturing a screen shot on exactly how high the options increased, as you see above, you could have sold your options for $2.55 (potentially $2.56, but let’s be conservative). That’s a gain of 60%!

In other words, even if you had gotten involved in the trade for the bare minimum amount of $159, you would have still had a gain of $95.40. Depending on your broker and the commissions you pay, it would probably be more about $89 profit. Generating $89 profit with only $159 in capital… pretty cool huh?

Options + Chatroom = Opportunity for EVERYONE

Big account or small account, the true power of options comes in the form of allowing everyone to get involved and take action on their trade ideas. Combine in the group of traders found within the Inner Circle trading group chatroom, and you have a recipe for success.

Big account or small account, the true power of options comes in the form of allowing everyone to get involved and take action on their trade ideas. Combine in the group of traders found within the Inner Circle trading group chatroom, and you have a recipe for success.

Do options intimidate you? Have you heard how complex and complicated they are? While there certainly are complex strategies out there, that stuff isn’t for me. I prefer KISS strategies (keep-it-simple-stupid).

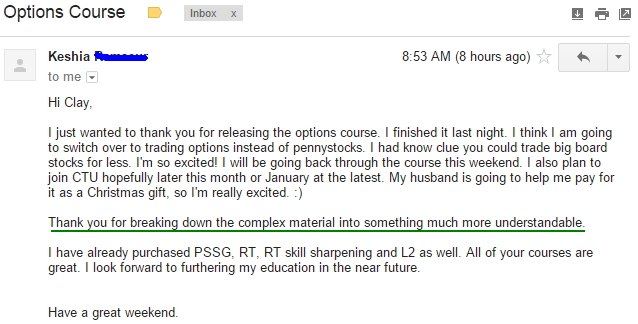

Don’t take my word for it. Below is one of the numerous testimonials I have received on my training course.

If you already trade options and are looking for other like-minded traders, then consider joining our private trading group. It’s hard to go wrong at $99 for an entire years’ worth of access, especially when many other services charge $50/$99 per month.

Either way, I hope this blog has shown you the power of options and how useful they can be as a tool in your trader toolbelt.