While “chat rooms” to most of the world are now considered ‘old school’, within the world of stock trading, live chat rooms remain very popular.

This comes with good reason. Putting yourself in a productive environment can truly add a whole new dimension to your trading toolbox as I discuss in this stock trading chat room blog article.

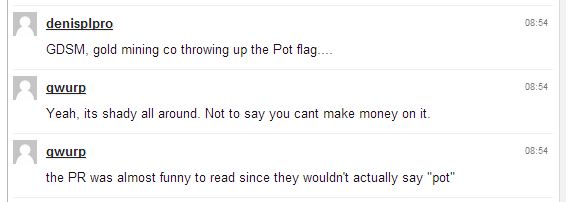

The best way to illustrate this is with an actual case study of an alert that occurred in the chat room for Gold Coast Mining Corp. (GDSM). I will post screen shots of the actual “comments” that were made, and then offer some insight on each of them.

(note: this case study involves a penny stock; however, within the premium section of the site, there are two chat rooms: “Stocks Under $1” and “Stocks Over $1”)

The Case Study of Trade Alert $GDSM

Below you will see when $GDSM first entered into the stock chat room. This was pre-market (you can see the times to the far right of each comment) on 2/12/14. As you can see, these two traders were discussing the press release that $GDSM had issued the previous day.

Two key attributes to take note of…

2 – Despite the fact of knowing it is a piece of garbage, they also know that it can still be traded none-the-less for profits. We don’t care what the price is of a stock, we are all about trading with diversity.

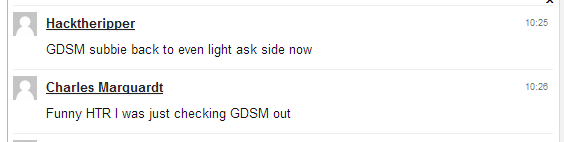

As we now progress through the day, you can see $GDSM makes another appearance, this time at 10:25 am est.

A couple of the room’s traders are now taking note that $GDSM has gone back to even on the day and is showing signs of potential life with the “light ask” (Level 2 jargon if you are not sure).

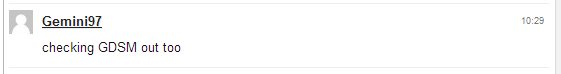

Here is $GDSM coming up again a few minutes later. Hmmmm…

The group is filled with disciplined traders (that you newer traders can learn a lot from!), so just because a stock is alerted, there is always more confirmation needed. In this case, you can see the trader is now commenting on the increase in volume (10-minutes later at 10:39 am est).

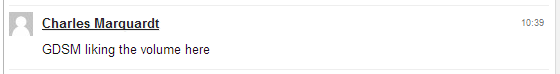

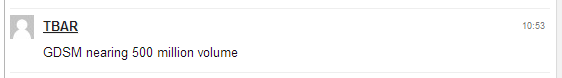

And then again, at 10:53 am est, another trader (notice how many traders begin to pick up on the “stock worthy” movements) mentions the volume.

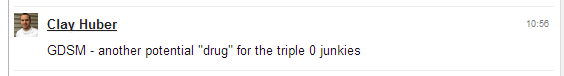

A few minutes later (because I also noticed volume), I decided to try and be funny with my analogy. I personally do not trade triple zero stocks, but I know many people like the adrenaline from them, so I decided to also make a note of the volume (in a “maybe” funny kinda way).

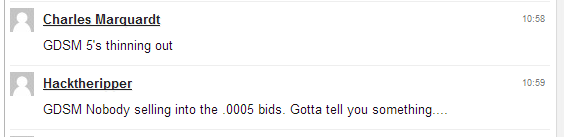

At essentially the same time, traders begin to comment on the price action. As you will soon see, are offering some valuable clues as to “what is coming”.

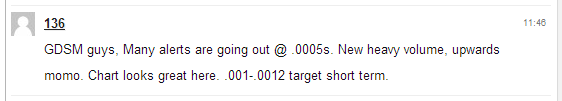

And yet, another new trader in the room brings up $GDSM commenting again on the volume, and this is the “action” that we were needing for confirmation

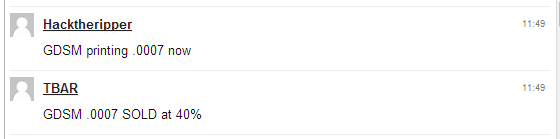

And to bring this story to an end (almost), you can see that with the $GDSM party underway, we already had some traders locking in some solid profits. 40% on your money in a couple of hours… pretty sure you can’t get those returns at your local bank!

So… how did the rest of the case study for $GDSM play out?

The stock price then went on to hit $.0012 not once, but on three separate occasions. Using a conservative entry of $.0006, that gave members of the live chat room a ‘profit window of 100%. I would say that’d pretty good for a days worth of work (even if you only captured half of the ‘profit window’).

Time to Take Action

You’ve seen just one example of how a “real time” stock alert can unfold within a “real time” efficient environment such as a chat room. If having this sort of trading tool to add to your trader toolbox seems like something worthwhile (how could it not???), then please consider joining my private trading group, The Inner Circle.

I will be the first to admit however that I am biased, so please do not take my word for it. I would ask that you click HERE though to read member testimonials, that way, you can get a 3rd party perspective on the service as a whole (including the live chat room).

Stop missing out on big movers such as $GDSM and join a well structured group where everyone has the same goal: to trade without emotion and locate / exploit profitable trading opportunities.