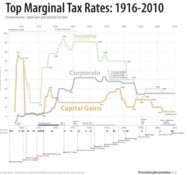

A 90% tax rate. Would a tax rate this high work today? I want to talk some economics 101 as we address this issue as it continues to be brought up more and more. The main framework in which this topic is brought up is in regards to justifying raising taxes even more on certain people. The line of reasoning goes, “Well, tax rates used to be as high as 90% and the economy not only survived it, the economy did very well. Therefore, the system can certainly handle raising taxes significantly more on the top earners.” To be fair, it is factually true that at one point tax rates where that high and that the economy did not fail, but did quite well. With that being said, there are some historical details that are being left out of this reasoning that make it a shaky baseline to use. I’m not here to try and persuade you one way or another, but as a group of people who seek to understand economics, wealth, money, etc., it’s important to at least have a full understanding of this talking point. I believe it is my job to throw out some considerations and then let you decide where you fall. If you disagree with me or anyone else, that’s fine. I still believe we can do that in an adult-like manner. No matter where you stand on the tax issue, my only point here is let’s consider ALL the facts about the 90% tax rate before choosing to use it as some kind of baseline of justification.