I wish I had a good excuse, but I don’t. I’ve just been slacking on these member case study articles, so any trolling you throw my way is well deserved.

I realize the title to this article might seem a bit far-fetched, but that’s the beauty of what having a system and strategy that fits your personality can achieve. You can accomplish milestones that may otherwise seem completely impossible.

The member in focus is very well known around the community (especially for those that are regulars in the trading chat rooms), none other than Nate Wilson. He’s what most people would classify as the class clown. While he does like to joke around a lot, he took his training serious from day one and he’s now reaping the rewards. I’m not going into details of his journey as he was a guest on The Stock Trading Reality Podcast, so if you want to know more of his background, you can listen to his interview here. He also came back for the 2 Year Anniversary episode, which you can listen to here.

The member in focus is very well known around the community (especially for those that are regulars in the trading chat rooms), none other than Nate Wilson. He’s what most people would classify as the class clown. While he does like to joke around a lot, he took his training serious from day one and he’s now reaping the rewards. I’m not going into details of his journey as he was a guest on The Stock Trading Reality Podcast, so if you want to know more of his background, you can listen to his interview here. He also came back for the 2 Year Anniversary episode, which you can listen to here.

I will be going over the evolution of this article (which will hopefully inspire and motivate you as a reader), and then I’ll focus on a couple learning points, one being VERY important.

One point of context about Nate, he works a FULL TIME JOB, so when you see the below results, you need to understand this is just extra income he’s generating for himself on top of his normal salary.

The Odd Problem I Had with Nate

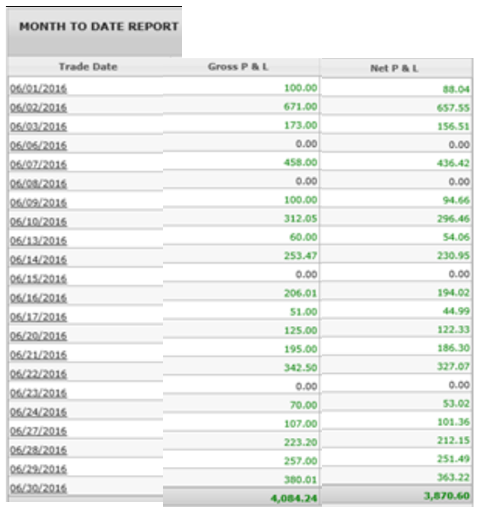

The history of this article is pretty funny. I originally had planned on just talking about Nate’s trading results from the month of June. I wanted to focus on why it is so important to manage risk and such, but then he sent me the below image from his trading account.

Disclosure: I have manipulated the images in order to get them into better formatting for the article. The original images were way too wide as they contained extra columns that were not relevant. I realize it is hard to see, but hey, it is what it is. I’m not going to knit pick to someone who has already been kind enough to publicly share their results.

I opened up the image in the email and then encountered an unexpected problem – there were not any red days! He profited $3,870.60 for the month of June, but never had a single losing day. In this day and age of internet trolls and skeptics, I knew these results were not good enough. It would only be a matter of time before the “you photo-shopped that!” accusations appeared. To be fair however, there is a whole ton of shadiness in the markets, so I do understand and respect traders being skeptical.

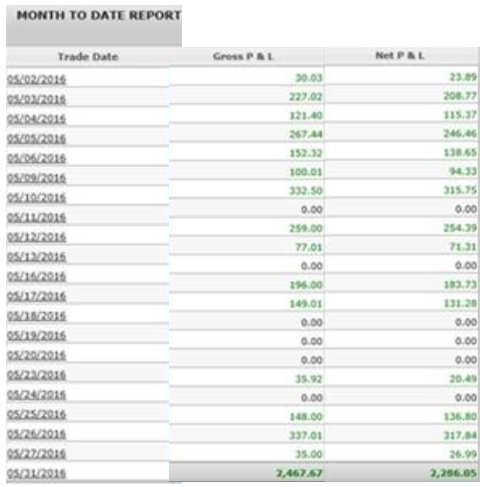

With this problem, I asked him to send over May’s results as no one would believe his June results. After complaining like he usually does, he sent over his results from May, seen below.

What the heck?!?!?! He generated an “extra income” (remember, Nate works a full time job) of $2,286.05 with yet again, no losing days?!?!

I’ll be honest, in most situations I would have become super skeptical at this point in time. The difference here being I know Nate has zero problem discussing/disclosing his losing trades. The reason I know this is because he appeared live on a ClayTrader University webinar (watch webinar HERE for CTU members) and talked about a trade where he broke about 100 rules and was in a world of pain. A situation that made him look pretty moronic; however, it provided a great learning opportunity, so he shared it so others could learn. Point being, Nate has a very “think whatever you want, I don’t care” type attitude, so knowing that, at this instant I was still giving him the benefit of the doubt.

The difference here being I know Nate has zero problem discussing/disclosing his losing trades. The reason I know this is because he appeared live on a ClayTrader University webinar (watch webinar HERE for CTU members) and talked about a trade where he broke about 100 rules and was in a world of pain. A situation that made him look pretty moronic; however, it provided a great learning opportunity, so he shared it so others could learn. Point being, Nate has a very “think whatever you want, I don’t care” type attitude, so knowing that, at this instant I was still giving him the benefit of the doubt.

I once again complained to Nate that no one would believe these results! I needed to see some losing days. He then sent me his results from April.

Ahhhhh!!! He is human! In April he had two loses. One in the amount of $52.05 and the other $305.72 (this loss happened first day of the month, which can be hard mentally, but Nate did a great job of bouncing back from it). He closed out April with “only” $1,668.54 in extra income – not too shabby at all when you factor in he’s also getting a salary.

Ahhhhh!!! He is human! In April he had two loses. One in the amount of $52.05 and the other $305.72 (this loss happened first day of the month, which can be hard mentally, but Nate did a great job of bouncing back from it). He closed out April with “only” $1,668.54 in extra income – not too shabby at all when you factor in he’s also getting a salary.

So there you have it. There were 64 trading days, and 62 of them were green. Well done Nate!

A List of Trading Lessons to Learn From

Now that you have seen how this all came together (totally unintentionally on my part), I want to comment on a few things that are important.

Now that you have seen how this all came together (totally unintentionally on my part), I want to comment on a few things that are important.

- Getting serious about trading does not mean you need to do it full time. I feel there is an “impression” out there that trading is only for those that hate their day jobs and want to do something else full time. This could not be further from the truth. While trading can certainly be done full time, it can be just as lucrative for those with full time jobs. In fact, another community member who has a full time job does very well for himself trading on the side, which is sort of an understatement considering he made $51,000 in a single day! Point being, if you have a full time job, it does not mean you cannot be successful at trading.

- Technical analysis (the use of “trading charts”) works. Nate and I have a very similar strategy and approach to the market, and the corner stone of our strategies is technical charts. Nothing is perfect, but when you take the time to learn how to properly use charts, you can bring consistency to your trading.

- Risk vs. Reward comes in two forms. The best way to explain this is maybe you saw Nate’s April results and thought, “Oh wow! His one loss wiped away multiple days of wins! That is bad risk management.” What you need to realize is yes, Nate’s losses when he takes them will be on the larger side compared to his wins; however, he wins a whole lot more than he loses.

Zero trade days are still “trade days”. Perhaps you noticed that on some days Nate made 0 trades. This is a perfect sign of patience and discipline. Many people don’t realize, there are three different types of trades in the market as I explain in detail here.

Zero trade days are still “trade days”. Perhaps you noticed that on some days Nate made 0 trades. This is a perfect sign of patience and discipline. Many people don’t realize, there are three different types of trades in the market as I explain in detail here.- Let the wins add up. I realize it’s much sexier from a marketing perspective to show some trader who is scoring $1,000 plus wins; however, that just is not realistic for most traders. As you hopefully noticed, Nate has lots of “small days”, but due to his consistency, they add up over time.

To wrap up point #5, how much did the “small days” add up to over the course of three months? The answer: $7,834.19. So… what would you do if you had an EXTRA $7,800 at the end of three months on top of your normal salary?

This brings me to the final learning lesson, and that is: an investment in education pays. Yeah, yeah, I get it. Some will now think, “Ohhhh I see Clay! All this just for a sale’s pitch!” And you know what? Absolutely! Because using charts to trade works!!!

Nate is a member of the ClayTrader University program. In only three months, he got a return on investment of 290%! If that is not an example of “education pays”, I don’t know what is.

Nate is a member of the ClayTrader University program. In only three months, he got a return on investment of 290%! If that is not an example of “education pays”, I don’t know what is.

If you’re interested in being shown how to use technical analysis for trading like what Nate is using, you can do so HERE.

You can get a behind the scenes tour of ClayTrader University HERE. I will walk you through all the various aspects of the program and show you all the content you gain access to.

As I always say, even if you don’t spend a dime on my site, I really hope I’ve accomplished my goal of motivating and inspiring you that it is possible to build consistency as a trader… even if you have a full time job! Hard work and dedication is required without any question, but for those who take it serious and work their butt’s off, the sky is the limit.