Greed. A single word, but oh so powerful in dictating how much success you have long term as a trader. I understand Gordon Gecko is famous for saying “greed is good”, but keep in mind where he ended up at the end of the movie.

I encountered a severe case of greed on social media, but instead of getting into an argument about it with this trader; I’m just going to turn it into a case study that hopefully you can learn from.

How It All Started

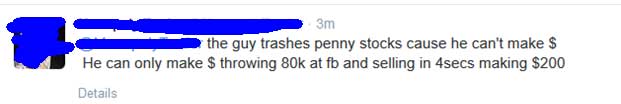

This all begins on Twitter. I’m sure your shocked to hear that people talk trash on Twitter (*unclick* sarcasm font). I noticed the below comment made about me.

First off, I do indeed trash penny stocks. If you don’t think penny stocks are trash, then you need to wake up. Keep in mind, nowhere did I say money can’t be made by trading penny stocks, but if you are treating them like blue chip companies, you will lose money… no doubt about it. I will also say that when you compare penny stocks to the world of options, penny stocks are a true joke as I prove here. Since we’re on the topic, I might as well mention the free video I did if maybe I’ve piqued your interest on learning options. How do penny stocks and options compare side by side? I review nine different areas and offer a comparison in this free video.

Let’s get back on topic. Now I do want to be fair. There are two possible situations this trader is in.

- They don’t understand percentages and yields. They just are not that strong in math.

- They are greedy.

Like I said, I want to be fair, so I have no idea what situation this trader is in, but let’s break down the “insult” (not really as I will prove with math) they hurled at me.

“He can only make $ throwing $80,000 at FB and selling in 4 seconds making $200”

Breaking Down the “Insult”

This trader’s insult is that by using $80,000, I am “only” able to make $200… I realize he also mentioned “in 4 seconds”, but I won’t even touch that for now.

I see his point. A $200 profit on an $80,000 principle is “only” a .25% gain (($200 / $80,000) x 100). So yes, the trader got me pretty good with the insult… IF you only look at this isolated trade.

The massive problem comes into play when we bring in the time element. According to this trader, .25% in four seconds is nothing special. I get it, when the world of stock trading gurus and penny stock pumpers is yelling from the rooftops about their “triple digit gains”, .25% seems like a laughable number, but is it?

At this point I want to say that I am going to be VERY fair and conservative and allow mathematics (not my opinion) to illustrate the rest of the story.

Looking at the Reality of the Situation… With Math

As I mentioned above, I am going to be very fair and conservative with my calculations. How so? Well, I’m not going to base any calculations from making .25% every four seconds. This is just not realistic. How about instead of every “four seconds”, we just “four times every day”. I mean there are multiple “four second” periods in a period of the trading day, so I think it is more than fair to simply say I only make .25% four times per day rather than per every four seconds.

With this being the case, let’s start at how much would I yield per day?

Well I make .25% four times a day, so 4 x .25% = 1%

If you find yourself looking at this number and laughing, it tells me one of two things. You have either been corrupted by the marketing/bragging gimmicks that are all over the place, OR, you don’t understand the concept of the word yield.

I’m not going to turn this into a math class, but essentially all “yield” means is that you start adding up percentages. So let’s continue…

There are five days in a week and each day I’m making 1%. 5 days per week x 1% per day = 5% per week.

Now here is where the power of percentages say “hello”. How many weeks are there in a year? 52. I’ll just use 50 though since the market does have some closures. This will give us the percentage gain for the year.

5% per week x 50 weeks in a year = 250% gain for the year

To me, gaining 250% on an $80,000 initial principle is pretty awesome!

Greed or Consistency in Your Trading?

Like I said at the beginning, perhaps this trader hurling the “insult” doesn’t understand math and that is why they made such an ignorant comment. As the math shows us, over time, .25% “gains” adds up very quickly. If you are looking at these numbers and are not impressed, then take it as a sign you are a greedy pig. There is no other way around it. If you would not be happy with a 250% gain in your portfolio for the year, then I don’t know what to tell you other than *oink oink* you are a pig.

What’s the learning lesson here?

My question to you is what are you focused on?

Are you only focused and worried about scoring big percent gainers on your trades?

Or are you focused on trading consistently, managing risk, and letting small “wimpy” percentages add up (“yield”) over time?

The pathway to success in the long run as a trader has nothing to do with big percentages. It has to do with managing risk and allowing your disciplined trades to add up over time. If you aren’t happy unless your trade scores you a 10% return or higher, then go donate your money to a charity because it won’t be with you for long.

Focus on the right areas of the market, and the rest will take care of itself.