For the traders that hang out in my private trading group chatroom, they know I have a new mission in regards to education and training: options.

This mission especially pertains to those traders currently trying to use penny stocks as their means to pull profits out of the market. Why? Well, quite frankly, penny stocks are a complete joke when you compare them to options.

Why Trade Penny Stocks?

Let’s face it, the majority of people who enter into penny stocks are doing so because they have smaller accounts and are looking for big gains. This is totally understandable. It’s hard to make money with $1,000 while trading stocks that cost $300. However, there is a much better pathway for traders with smaller accounts.

Some may accuse me of only talking about options and how attractive they are because I have an options course for sale, this is flawed logic. Flawed in what way? I also have a penny stock course for sale, so it really is not doing me any good to be bashing penny stocks. My point, I truly believe in options.

Why Penny Stocks are a Joke

Manipulation. Scummy CEO’s and management. Pumps-and-dumps. Low volume. Debt. Dilution. I’m sure you’ve heard of or experienced any number of these common occurrences with penny stocks. Believe it or not, these occurrences are NOT why I’m calling penny stocks a joke.

There are three main areas that really cause penny stocks to drop into the category of joke. Many traders don’t even realize these attributes exist, but more importantly, can be avoided!

Pattern-Day-Trader Rule

The first bit of evidence, in my opinion, should be all you need to hear in order to make you want to learn options. For those traders with less than $25,000 and therefore putting them at the mercy of the stupid government regulation pattern-day-trading (PDT) rule, options are a true game changer. No more chained hands. In short, options play a big role in being able to avoid the PDT rule. In other words, with options, you can essentially trade as much as you want on a weekly basis (which is NOT possible with penny stocks). Learn more about how to accomplish this HERE.

The first bit of evidence, in my opinion, should be all you need to hear in order to make you want to learn options. For those traders with less than $25,000 and therefore putting them at the mercy of the stupid government regulation pattern-day-trading (PDT) rule, options are a true game changer. No more chained hands. In short, options play a big role in being able to avoid the PDT rule. In other words, with options, you can essentially trade as much as you want on a weekly basis (which is NOT possible with penny stocks). Learn more about how to accomplish this HERE.

Making Money When Prices Go Down

The second bit of evidence revolves around one word: risk. This is particularly the case when you talk about penny stocks and shorting (meaning, you make money when the price of a penny stock decreases). Many penny stock traders are on the constant search to find out “how to short penny stocks”, and while I do understand the logic and attractiveness of this supposed strategy, when you look at it more deeply, you’ll see it is not so attractive. In fact, as my article Shorting Penny Stocks is Stupid! Here’s Why. displays, it truly makes very little sense.

The second bit of evidence revolves around one word: risk. This is particularly the case when you talk about penny stocks and shorting (meaning, you make money when the price of a penny stock decreases). Many penny stock traders are on the constant search to find out “how to short penny stocks”, and while I do understand the logic and attractiveness of this supposed strategy, when you look at it more deeply, you’ll see it is not so attractive. In fact, as my article Shorting Penny Stocks is Stupid! Here’s Why. displays, it truly makes very little sense.

Penny Stock Movement Cycles

Due to the fact that penny stocks can go through cycles where they explode in price action (think back to the pot stock boom), I will never say penny stocks are 100% worthless. Understanding how to trade them is something that should be in your trader tool belt; however, when it comes to the consistency of big gain opportunities, a penny stock truly cannot compete with stock options.

What do I mean? Penny stocks have big moves every couple of weeks. Stock options have big moves on a daily basis, and I mean this literally. There are all sorts of examples of this, including this documented chat room alert that netted 60% gains in less than three hours. The video on this page also gives an additional three real life examples of options and how they move big.

What do I mean? Penny stocks have big moves every couple of weeks. Stock options have big moves on a daily basis, and I mean this literally. There are all sorts of examples of this, including this documented chat room alert that netted 60% gains in less than three hours. The video on this page also gives an additional three real life examples of options and how they move big.

I wanted to document another option trade alert from the chat room. This way, you can see that options sincerely do make big moves on a consistent basis. Keep on reading to see how within the span of a few hours, 65% could have been made. The crazy thing about this is that the 65% number is actually on the conservative side of the calculations as I will explain.

The Option Set-Up and Alert

This option alert came thanks to Amazon.com Inc. ($AMZN). This first talking point illustrates how I am being conservative in the calculation numbers.

I was actually LATE in giving this alert. Another member of the trading group originally alerted it; however, we will base the calculations off of my alert and my entry point to play things on the conservative end.

You can see the original alert came about an hour sooner than mine.

My alert came over an hour later…

when the technical stock chart for $AMZN looked like this…

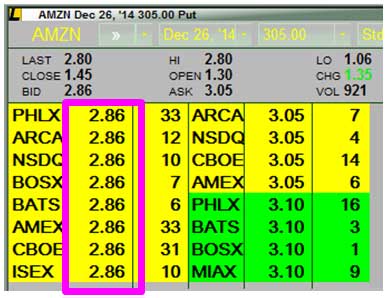

And I bought some options for $1.73. Again, had I actually bought when the original alert was given, I could have gotten a MUCH BETTER entry point than $1.73, but let’s be conservative and use my late entry point. As a side note to show how little of money is needed to get involved in options, all you would have needed to get involved in the trade at minimum would have been $173.

![]()

The Option Alert Aftermath

Now let’s see how the remainder of the day unfolded. This alert was actually made on Christmas Eve Day. I bring this up for two reasons.

- The market was only open for a half day until 1 pm est.

- Even with a “slow” day for the market (I mean it was the day before Christmas!), you will see just how much options can still move.

As you can see, both the other member and myself were correct about the price of $AMZN falling in value. Take a look at what happened to the price of $AMZN’s stock..

This is where options really get to display their power. You may be thinking, so what? $AMZN’s drop from $305 to $302.90 was ONLY a move of .69%. That’s not even 1%. Who cares? I used to think this exact same way… but take a look below. Notice what the options were then worth after this “small” move of “only” .69%.

Yup. You are reading that correctly. The options increased in value by 65% up to $2.86 (based off an entry point of $1.73). To pile on the awesomeness of options, this all occurred in less than three hours. Pretty cool huh?

Remember, we are being conservative too! Had I acted on the original alert, I would have been looking at an opportunity window of easily over 100%.

Learn Options and Laugh at Penny Stocks

Whether or not you believe me that these types of moves happen over and over and over again within the options market, that’s up to you. All I can really beg you to do is considering learning options so you can see for yourself.

Also, don’t be like I was for the longest time thinking options are super confusing and complex. Can they be complex? Yes. Do they “have” to be that way? Absolutely not!

This was one of my motivations for adding Options Trading Simplified to the Trading Freedom Pathway. Way too many places out there make options sound and seem way more complicated than they need to be. It scares people off and makes them stick with low volume penny stocks.

As much as I’d love to have you invest into my course so I can teach you how simple options trading is, even if you tell me, No Clay, that’s not happening!, my attitude still won’t change. You need to get out there and learn options. Open up a whole new world for yourself that will truly have you more likely than never wanting to touch a penny stock ever again.