Do you fall into the category of stupid stock trader? If you are not sure, you’re about to get that question answered for you.

For those of you who have read any of my other stock trader blog articles, you know I am a huge believer in using “real life” situations to explain a topic rather then just talking about “theory”.

For those of you who have read any of my other stock trader blog articles, you know I am a huge believer in using “real life” situations to explain a topic rather then just talking about “theory”.

To illustrate this point about how stupid stock traders operate, I’m going to use the company Olie Inc, (OLIE).

While it is a sub penny stock, that fact does not matter in regards to the topic of this article: things stupid stock traders do.

Whether you are trading a penny stock or a blue chip company, trading at all levels is controlled by emotion and psychology. With that being the case, although this example is using a penny stock, it applies to every single trading action you perform.

Stupid Stock Traders Do Not Use Technical Charts

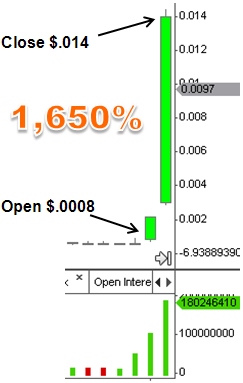

Any successful stock trader is going to know how to read stock charts. In the case of $OLIE, they would surely have taken notice of the chart that looked like this…

Yes, you are reading that correctly (and I triple checked my math), this chart was up, in 2 days, 1,650%.

If you are thinking to yourself, “candlestick charts are too complicated to read, therefore this would not have helped me”, then too bad. This is NOT an valid excuse. Why not? You could simply just use a line chart as those are by far the easiest to read for finding opening and closing prices.

Point being, by using a stock chart (whether candlestick or line), the smart stock traders saw this absurd percentage the stock price was up in only two days, and the stupid stock traders either:

- Had no idea because they don’t use charts.

- Noticed but didn’t care.

Either of these push you into the stupid stock traders category.

Stupid Stock Traders Listen to Others, Not the Chart

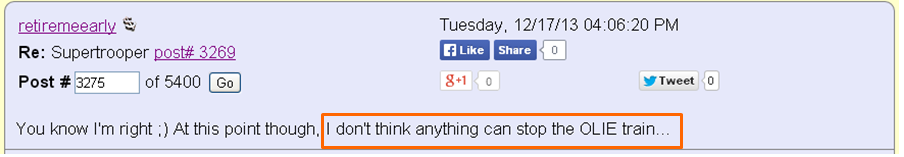

Carrying on with the story of $OLIE, at the end of the second day when the closing bell had rung, and the stock price was sitting up 1,650% from where it started the day before, a quick trip to the world of message board forums revealed these types of “thoughts” from traders.

So… the stock is up 1,650% in a matter of only two days, and according to this poster, they don’t think anything can stop the price from continuing to move up? Really? Not even from profit takers?

This leaves us with one of two possible conclusions for this general thought process:

- The trader sincerely believes this thought.

- The trader does not believe it; however, they are planning on selling their shares the next morning, so in order to get the stupid stock traders to buy their shares so they can “dump” their position, they need to create as much excitement as possible.

Keeping the wise words of Warren Buffet in mind when he stated:

Be fearful when others are greedy and greedy when others are fearful.

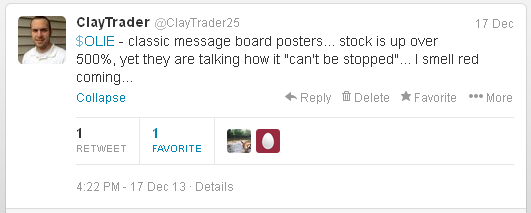

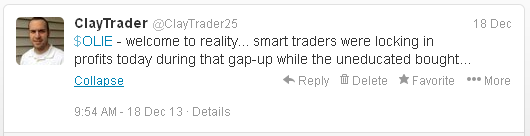

and then after seeing these sorts of message board posts made, I couldn’t resist myself, so I made this public comment on my Twitter page:

I should note, this thought process occurs everywhere in the market. In this particular instance, it was a message board poster; however, you don’t have to look very hard to find other examples of this mentality. All you need to do is turn on your TV and listen to the talking heads.

Quick Stupid Stock Traders Recap

You are a stupid stock trader if…

- You don’t use technical stock charts, so you have no idea “how much” a stock price has moved over a certain period of time.

- You do use charts, but just don’t listen to them.

- You take your advice from random message board posters or talking heads on TV.

What happens to the stupid stock traders that fall into one or more of the categories above? Keep on reading…

Stupid Stock Traders are Taken Advantage of and Used

Perhaps this is a bit harsh, but it is the truth. I will never concede on that opinion.

The fact of that matter is, I personally love stupid stock traders. Without stupid stock traders, who would buy shares at ridiculous areas? Who would allow me to gain that extra profit from selling a position a tad higher than even I thought was possible?

A picture is worth a thousand words, and the action on $OLIE illustrates this point with exact accuracy.

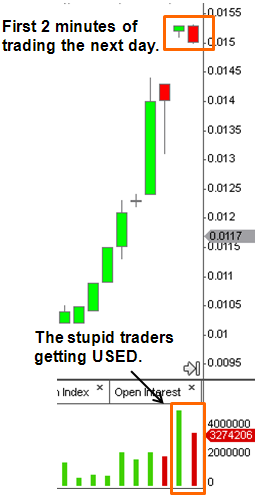

Look at what happened the opening minutes of the following day (the chart is covering a one minute time frame – meaning, each “bar” represents 1 minute worth of trading action).

Even despite the gap-up in price, the stupid stock traders still piled into the stock. The first two minutes of trading in $OLIE were where the smart and savvy technical chart traders were mopping up the floor with the soon-to-be blood of the stupid stock traders.

Even despite the gap-up in price, the stupid stock traders still piled into the stock. The first two minutes of trading in $OLIE were where the smart and savvy technical chart traders were mopping up the floor with the soon-to-be blood of the stupid stock traders.

Maybe that is a bit of a gruesome analogy; however, the stock market is a gruesome place for those that aren’t prepared or educated to handle it.

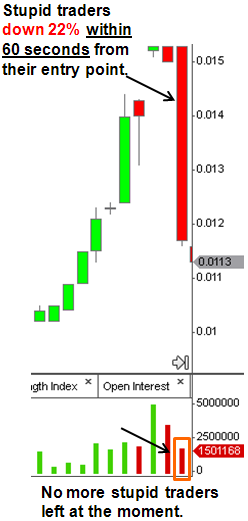

The amazing thing with technical analysis is that it tells you exactly when the stupid stock traders are all gone. In the case of $OLIE, it happened during the 3rd minute of the day.

In essentially a blink of an eye, the stupid stock traders were done buying, and as soon as that happened, they were instantly down 22% on their positions.

Technical analysis by way of the volume (notice how much “smaller” the volume bar now is) shows how when the stupid traders are gone, the sellers no longer have anyone to sell to, so they must begin to sell for much lower prices. This in return creates a “low volume sell off”.

I can assure you this, the smart stock traders who had their shares bought from them up at the top were not complaining about the stupidity (greed) of others. They were the ones trading without emotion, and using the emotion of greed in order to take advantage of the situation and profit.

This brings me to the closing chapter of the story; however, it is by far the most important lesson to be learned: short term fools gold.

Stupid Stock Traders Harvest Fools Gold

I truly hope that at this point in the $OLIE story, we can all agree that buying during the first two minutes was NOT a smart entry point. As I alluded to earlier, the story does not end yet! In fact, it turns out to be a happy ending for even the stupid stock traders. Look at what happened!

I truly hope that at this point in the $OLIE story, we can all agree that buying during the first two minutes was NOT a smart entry point. As I alluded to earlier, the story does not end yet! In fact, it turns out to be a happy ending for even the stupid stock traders. Look at what happened!

This my friends is a classic example of fool’s gold. This type of “happy ending” is one of the biggest deceivers in all the financial markets.

I know this saying is extremely overused, but I’m going to use it anyways: the stupid traders may have won this battle, but they haven’t won the war. And rest assured, they will NEVER (I repeat NEVER) win the war.

What is “The War” for a Stock Trader?

Simply put, to grow your portfolio. Nothing more. Nothing less.

And… if you think that a viable long term strategy is this:

- Enter into a trade at a very poor area.

- Cross fingers.

- Watch your position decline by 46%.

- Hope you get bailed out. – then you have just placed yourself into the stupid stock traders category.

There is no denying that fools gold can and will bail you out of stupid trades every now and then; but, if you think you can have a successful long term trading career/hobby with this mind set and strategy, then the fools gold has done exactly that: fooled you.

Are You a Stupid Stock Trader? I Know I Was.

Can you relate to any of this? Not in regards to $OLIE and this trade in particular, but in general. Ever find yourself entering into a trade and then asking, “Why did I do that?”. Or taking loses on trades and then, when looking back at it, having no idea “why” the stock didn’t make you money?

Trust me, there is absolutely no shame in admitting to being a stupid stock trader. Admitting to myself that I was being stupid was the key step in allowing myself to break out of the chains of this vicious stock trader cycle that causes the majority of traders to fail.

During the bloodshed on $OLIE, I made another comment on my Twitter account…

What did I and do I mean by uneducated?

What did I and do I mean by uneducated?

It has nothing to do with whether or not you have a college degree (or heck, even a high school diploma).

It has everything to do with whether or not you have a strategy. In particular, do you have some kind of analysis method to determine entry and exit points for your trades.

After admitting to myself I was being a stupid stock trader, I decided to learn technical analysis. I really struggled with my emotions while trading, and due to technical analysis’ ability to control trader emotion, it seemed like a logical choice for me.

What is the proper analysis method for you? I don’t know! That is your call… however, what I do know is that if you are depending on fools gold and are in denial about being a stupid trader, you will never be successful in the long run.

If you, like myself, struggle with emotions while trading, I would advise technical analysis. I have multiple instant download courses that you can check out HERE.

If you found this article helpful and are looking for not only more premium content, but weekly trade ideas from my personal stock scans, consider joining The Inner Circle. We have a great group of traders ranging from beginners to battle tested stock trading veterans. And no worries, this all comes at a very very affordable price, $2 per week. That is less than one (maybe two) cups of coffee per week. A very reasonable offer.

Leave Your Comments!

Please, leave your comments below! I enjoy hearing from other traders, and would love to hear about any “$OLIE” type moments you have had. There is no shame either. We have all had “that-was-stupid” moments, so if anything, we can all sit back and learn from one another.